The right-wing blogosphere has lately been touting a table that the Norquistina Tax Foundation cherry-picked from a recent OECD study, showing that the U.S. has the most progressive income tax system in the OECD–perhaps excepting Ireland.

This may well be true. But I’m not totally sure what they’re trying to say–except maybe that the U.S. tax system should be less progressive? This is the exact opposite of their typical equality arguments, though: we’re less equal, and we’ve grown faster (we haven’t actually, but they like to think we have), so we should be even more unequal. If that argument holds, shouldn’t we have a more progressive tax system?

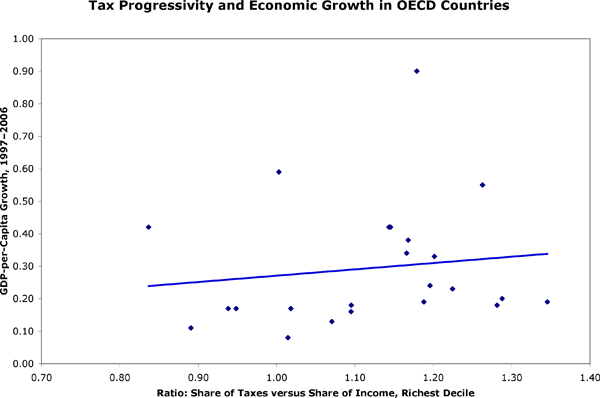

In any case, it got me wondering: do more progressive tax systems in developed economies correlate with faster or slower growth?

Answer: more progressive = faster growth. The correlation is .13 (using either of the measures in the Tax Foundation table). Not a huge correlation, but it does show that a strongly progressive tax system does not hurt growth; if anything, the contrary is true.

There are no big X-axis outliers here (which tend to pull trend lines and correlation coefficients around inordinately), but it’s worth looking at a subset of countries that are largely similar, in hopes of ameliorating the effects of lurking, confounding, or otherwise pesky variables that might be polluting the analysis.

If you exclude very small, eastern European, and non-European countries. (Leaving Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Sweden, Switzerland, United Kingdom, United States), the correlation goes up to .21.

If you also exclude Australia, Canada, and the U.S., leaving only the advanced European countries — a nice, somewhat uniform comparison set — the correlation hits .36.

So we can say that at least for developed European countries, the Tax Foundation data shows (by social science standards) a strong correlation between progressive tax systems and increasing prosperity.

Is this what the Tax Foundation was trying to point out?

This is a single statistical slice/snapshot from a huge data set, and many things could paint a different picture: the taxes being analyzed in this particular table by the OECD, the Tax Foundation’s calculation methods based on those figures, the periods being analyzed (by the OECD and by me here, for growth), etc. I don’t know of any serious regression analyses that seek to control for these variables. I’d especially like to find any surveys or meta-analyses of such studies.

Comments

One response to “Want Prosperity? Tax the Rich”

[…] taxation also seems to be more economically efficient over the long term — resulting in faster economic growth. (Or at least, no slower growth.) Unfortunately, that progressivity would go away in the good times […]