No, I’m not talking about Piketty hitting the Times bestseller list. And it’s not just wild-eyed lefty Frenchman who are expressing concern about the state of world capital these days. Mitt Romney’s shop was beating this drum loudly more than a year ago.

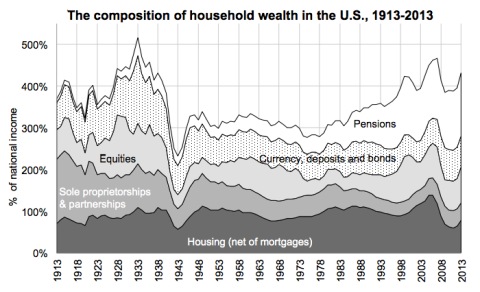

One of the central takeaways from Piketty’s Capital in the 21st Century is the U-shaped long-term trend in the capital-to-income ratio, especially in rich countries. He uses “capital” synonymously with “wealth.” Here are the latest numbers for the U.S. from his compatriots Saez and Zucman (source PDF):

The economic relationship between wealth (or net worth, financial assets minus liabilities) and real capital is a sticky one, even if you’re only considering “fixed capital” — structures, equipment (hardware), and software. It’s even more so if you consider human skills, knowledge (i.e. patents), organizational capital, etc. (The line between organizational capital and “software” is getting especially blurry these days; what would Vanguard’s, much less Google’s, value be without their web presence?) And more so again if you consider natural capital like land and what’s on/under it.

But “Wealth in the 21st Century” wouldn’t have had quite the same ring to it, so let’s just go with it, with the knowledge that we’re talking about wealth (“financial capital”), and wealth has some indeterminate but somewhat representative relationship to real assets/capital. We can at least say, loosely, that financial assets are claims on real assets, or on the production that’s enabled by those assets.

So what about Bain Capital, Romney’s shop? Here from their December 10, 2012 report (PDF; hat tip to the always-remarkable Izabella Kaminska, and to Climateer Investing).

World awash in nearly one quadrillion of cheap capital by end of decade, according to new Bain & Company report

Their takeaways include:

The capital glut will be accompanied by persistently low real interest rates, high volatility and thin real rates of return.

Sound like secular stagnation to you?

Also:

The ever-present danger of asset inflation will contribute to an overall steepening of the investment risk curve… companies will need to strengthen their bubble-detection capabilities

In short, there’s a huge amount of money floating around out there relative to income and production. (In Steve World, all financial assets embody money, and the money stock is the total value of financial assets — including dollar bills, deeds, or other formal financial claims — regardless of how currency-like those things are. Equating currency and currency-like things with money is conceptually incoherent.)

With so much money around, is it any surprise that people are lending it cheap?

As usual I have much more to say on this but instead I’ll hand it off to Jesse Livermore, who recently wrote one of the clearest and most cogent posts I’ve seen in years on financial asset values, hence wealth. I’ve been meaning to link to it. Read the whole thing.

The Single Greatest Predictor of Future Stock Market Returns

Hint: it’s about what the herd does with all that money.

Cross-posted at Angry Bear.