• Since Social Security started it has always brought in more money than was spent. It contributes a surplus to the total federal budget. That’s true today and will continue for quite some time.

• The extra revenue needed to make SS solid far beyond the foreseeable future (75 years) is tiny: 0.6% of GDP.

• A 0.6% revenue increase would not be a big burden. The U.S. has been taxing about 28% of GDP for decades, compared to 30-50% in other rich countries (average: 40%).

• Coincidentally, Scrapping the Cap on SS contributions — so high earners paid payroll tax above $110K — would deliver … 0.6% of GDP.

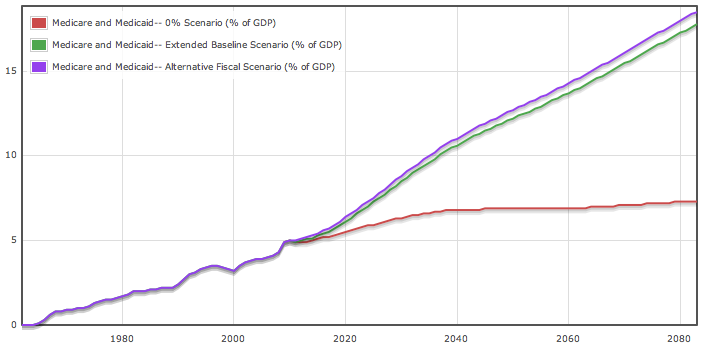

Worried about our fiscal future? It’s the health care costs, stupid. What providers charge.

U.S. providers charge two to five times what they charge in other countries, and it’s rising faster — and faster than wages, GDP, inflation.

If you’re not talking about that, you have nothing useful to say about our fiscal future:

Cross-posted at Angry Bear.

Comments

9 responses to “Social Security: The Elevator Pitch”

[…] Cross-posted at Asymptosis. […]

You and my favorite blogger James Kwak are totally on the same page on this stuff. I would love to see you and Bruce Krasting go at it in like 1 hour video debate and see who was the last man standing. Krasting has been anticipating the doom of Social Security at any moment’s notice. Of course I exaggerate, but if you read his columns on the matter you would know I don’t exaggerate Krasting’s tizzy and terror by much.

“so high earners paid payroll tax above $110K — would deliver … 0.6% of GDP.”

And that’s “uncapped taxes, uncapped benefits”.

“Uncapped taxes, capped benefits” would deliver 0.9% of GDP.

Why don’t we just admit that taxes don’t actually fund anything in a non-convertible floating rate monetary regime. There purpose is to withdraw net financial assets from non-government to decrease aggregate demand as the economy approaches full employment, in order to prevent inflation when the economy is no longer able to expand sufficiently in a timely way to meet effective demand.

FICA is essentially a needless regressive tax on labor that makes room for lower taxes on gains from economic rent at the top. What sense does that make?

@Tom Hickey

On your first question, I’m thinking it’s gonna take a long time for people to grasp that, but it may happen eventually…

“FICA is essentially a needless regressive tax on labor that makes room for lower taxes on gains from economic rent at the top. What sense does that make?”

I’m with ya. See:

http://www.asymptosis.com/is-the-social-security-trust-fund-a-liberal-own-goal.html

Has Coberly seen that one yet? Should *really* get him going… 😉

Would be nice if elevator pitch included links to evidence points.

Eliminating the cap and not changing benefits has bizarre consequences. For some it would mean getting SS checks of $12k a month! (not at all what the system is about) The real problem is that it would imply an incremental tax of 12.4% on high income workers.

Higher taxes are needed to cover a budget shortfall at the national level. But you can’t simultaneously add another income tax on that same group. The folks who love SS have to understand that some of the “solutions” will just hurt the real economy.

I favor raising the cap and cutting the benefit formula (.5). The amount of the incremental tax would be lost by the payer. But the amount of the lost tax would be much smaller than the 12.4%.

But my plan does not work either. The reason is simple. There is not going to be any solution put forward for SS that starts with “SS taxes are going up….” That is both the political and economic reality.

So yes, I conclude that the prospects for SS are not bright. I don’t see the economy recovering on a sustained basis so that SS would again balance its cash books. The cash deficits will grow quickly. Much quicker than has been anticipated.

I was right two years ago, when I projected that SS would go permanently cash flow negative in 2010. I will also be proven right that the SSTF balance will top out in 2017, five years earlier than is currently assumed.

I’ve been playing around with video. I think it’s the next “thing” in blogs. I would consider something with you on this topic?

bk

@Bruce Krasting “I’ve been playing around with video. I think it’s the next “thing†in blogs. I would consider something with you on this topic?”

Sounds interesting. But Bruce is more of an expert than me on the nitty gritty. I do have mixed feelings about the whole thing (see my Asymptosis link above), which might be useful…

“Since Social Security started it has always brought in more money than was spent. It contributes a surplus to the total federal budget. That’s true today and will continue for quite some time.”

Ugh, knowing that while understanding modern monetary systems and how that ‘surplus’ is really a form of demand destruction via taxation makes me a woozie.