Much ado is made of the Fed’s “credibility,” which is dog-whistle-speak for its ability, willingness, and decided inclination to jump all over any (expected or imagined) whiff of that horrifying threat — inflation! — especially the most terrifying bogeyman, “wage inflation.”

You won’t, on the other hand, find “credibility” discussed when people speak of the Fed’s inevitably weak-kneed inclination to raise inflation (expectations).

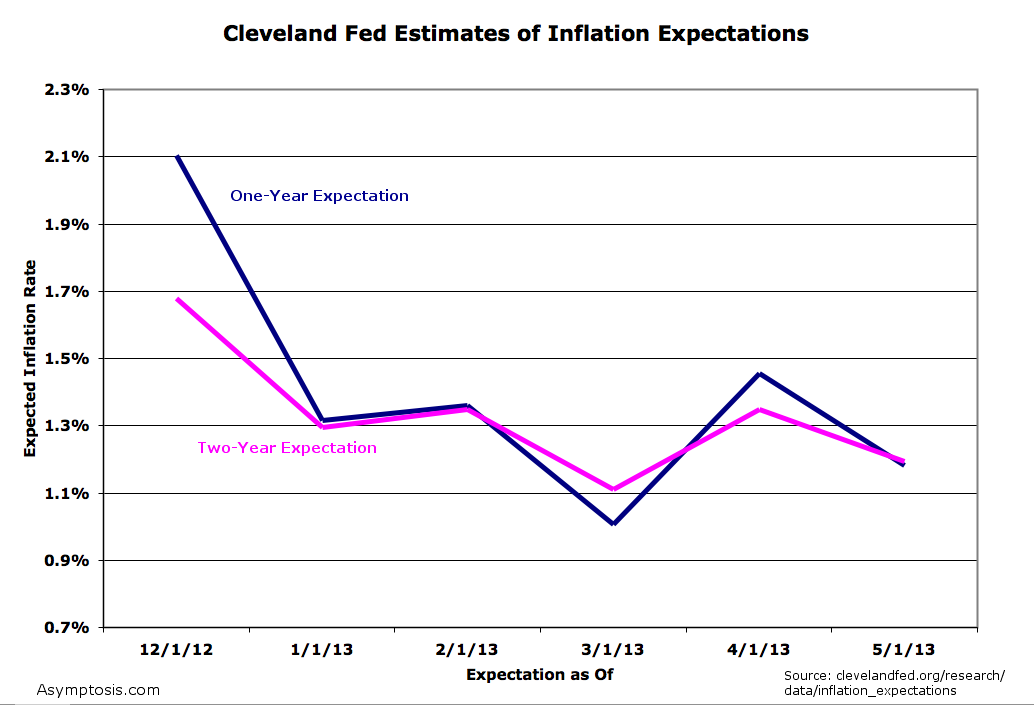

So after thirty years of diligently establishing its reputation for credibility, the Fed has no credibility. They announce on December 12 that they’ll allow inflation to go as high as 2.5% (shock! awe!). And what happens to inflation expectations?

Yes, it was a limp-wristed “promise”: they would only allow that irresponsibly dangerous hyperinflationary jump to 2.5% if unemployment remained above 6.5%. (Pick a mandate, any mandate. You know which one they’ll choose.)

So after three decades of diligently protecting responsible creditors from the manifest evils of inflation, and imposing responsibility on feckless, impatient entrepreneurial, risk-taking borrowers, nobody believes for an internet minute that the Fed can or will address the unemployment side of their mandate — that it has the wherewithal to do so, or the inclination if it did.

Got credibility?

Cross-posted at Angry Bear.

Comments

3 responses to “How The Great Moderation Destroyed the Fed’s Credibility”

[…] Cross-posted at Asymptosis. […]

I’m with you…

The Fed in the past somehow took credit for lowering unemployment because of the secondary effects of monetary policy. It was an illusion. I hear what you say about credibility.

The Fed has no direct control over wages, nor over employment. They can only hope that the liquidity they provide will be turned into jobs and economic growth.

And now we see the illusion plain as day. It is silly for the Fed to have a mandate for lower unemployment. It is not under their influence in truth.

And for inflation…

Inflation = unit labor costs/labor share

What does low inflation tell us? … relatively lower unit labor costs.

http://effectivedemand.typepad.com/ed/2013/05/labor-share-inflation-unit-labor-costs.html

@Edward Lambert “Inflation = unit labor costs/labor share”

I’d be careful bruiting a definition of inflation that does not basically mean “higher prices for a representative basket of goods.”

That doesn’t mean you’re not saying something important here. Just that people are unlikely to understand it if you use an idiosyncratic definition of a word that they (at least think they) already understand.