I don’t think there’s anything eye-popping or revolutionary this post, but it’s thinking that I’ve been finding useful.

Long before Larry Summers bruited his recent ideas about secular stagnation and the need for bubbles, I came up against this great line from Nick Rowe (April 2011):

The economy wants a Ponzi scheme.

I’ve been pondering that line ever since. (As usual with Nick, read the whole post.) Pretty quickly, I came to an even more radical belief:

The economy is a Ponzi scheme.

Economies are exercises in log-rolling, but with magical logs that expand when more people climb aboard and run faster, and and contract when people slow down or fall off. People can fall off because there’s not enough room on the log, because they can’t run fast enough, or because they try to stand still or run too slowly. (Sorry to torture the metaphor so.)

To put it another way:

Economies are confidence games.

When people are confidently optimistic (the two are not synonymous), more people jump on the log and run harder, because they think there will be personal profit in it.

But where does that confidence come from? I would suggest that most people form their expectations for the future based on the present and recent past. (A very reasonable Bayesian stance.) How much money do I have? How much is coming in? How do those compare to the recent past? (Market monetarists: Idle guesses, surmises, and predictions about the Fed’s future policy stance seem wan, weak, and feckless compared to those very tangible and tally-able present indicators.)

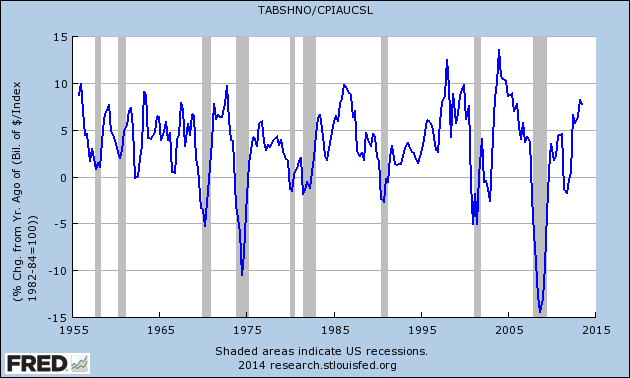

Which bring me back to a current favorite graphic, showing that every recession since 1960 was preceded by a decline in the inflation-adjusted (“real”) value of household assets:

There are only two instances (since 1960) where this measure fell below zero and there was not a recession: 2002 and 2011. Both look like aftershocks/carry-ons from the preceding recession. (Or: Maybe these times are different?? Think: massively higher household debt.)

The confidence story I’m telling here: people give huge weight to their current wealth/assets/net worth, and recent changes in those measures, when forming expectations for future growth — far more weight than they give, for instance, to their predictions of Fed behavior (the huge mass of people have no such predictions). This may be foolish or it may not be, but it’s what people do. (They undoubtedly also give big weight to current income and recent changes in income. I’ll let somebody else graph that.)

Or you could say: declines in household assets means there’s less money. (All financial assets embody money.) And at that point you can invoke a straightforward monetarist explanation — with a Minskyish self-perpetuating component added — for recessions.

The key point: the decline in real household assets always precedes the recession. It’s at least a leading indicator of real production declines, and at most a cause. When people feel poorer, they act poorer. (I told you this post wasn’t revolutionary thinking.) They spend less. So there’s less production. (In an 80% service economy with just-in-time production of many physical goods, if spending doesn’t happen, production doesn’t happen.) So there’s less (demand for) labor. The log shrinks and slows down. GDP and employment (growth) slow or decline.

Okay, yeah, Wealth Effect, blah blah blah. But the assertion I’m making is that people don’t just spend more when they feel wealthy or wealthier. They raise their expectations of future wealth, and consume/invest according to that. You get a positive or negative self-perpetuating feedback effect.

Going abstruse with this: Given the widespread belief that quantitative easing only really achieves any effect by buoying financial-asset prices (I include deeds in that class of assets), is it reasonable to suggest that the Fed is actually (and unconsciously, and arguably incompetently) engaged in Real Household Asset-Value Targeting (RHHAVT)? Can they limit the feedback effects? Should they shift to level targeting (RHHAVLT)?

Cross-posted at Angry Bear.