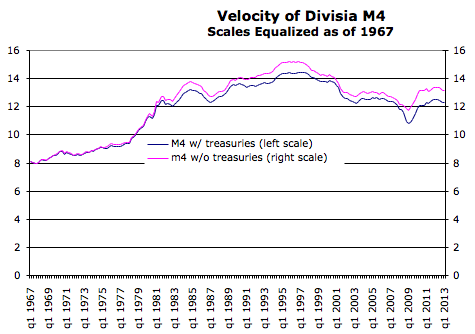

I was poking around at the very interesting Divisia measures of money, and came up with the following chart.

Update: Spreadsheet error in original graph. Result: this has little to impart. Never mind. Thanks to Mark Sadowski for pointing it out.

Which has me, once again, asking monetarists the question in the title of this post. For instance: are Treasuries money? How moneyish are they? We have two presumably valid measures here telling wildly different stories in MV=PY World. What’s your story?

The numbers in this chart are purely arbitrary (Divisia measures are just indexes, here divided into GDP, which is in dollars); it’s about the relative changes.

Cross-posted at Angry Bear.

Comments

3 responses to “Just What Exactly Do You Mean by “Money,” Buster? #23”

[…] Cross-posted at Asymptosis. […]

What are your thoughts on using the Divisia measures to understand macroeconomic cycles from an endogenous money perspective? I ask because the measures appear to be based on the monetarist concept of “moneyness”, yet the broad measures which include Treasuries appear relevant for discussion of NFAs.

@Joshua Wojnilower First, please note the update. Yes, I feel stupid.

I’m rather skeptical about all monetary aggregate measures vis-a-vis growth and inflation, now that the Fed: 1. pays interest on reserves, 2. Manages interest rates via the IOR/discount window corridor, and 3. manages portfolio preferences via balance-sheet expansion/contraction.