Of all the reading in Modern Monetary Theory that I’ve been doing of late, perhaps the most eyebrow-raising paragraphs I’ve come across are these, from the redoubtable Randall Wray:

With one brief exception, the federal government has been in debt every year since 1776. In January 1835, for the first and only time in U.S. history, the public debt was retired, and a budget surplus was maintained for the next two years in order to accumulate what Treasury Secretary Levi Woodbury called “a fund to meet future deficits.” (See Wray 1998, p. 63, and Stabile and Cantor 1991.) In 1837 the economy collapsed into a deep depression that drove the budget into deficit, and the federal government has been in debt ever since.

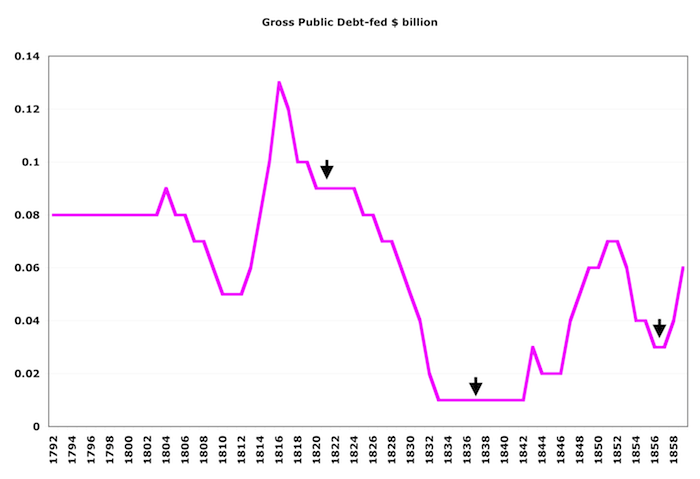

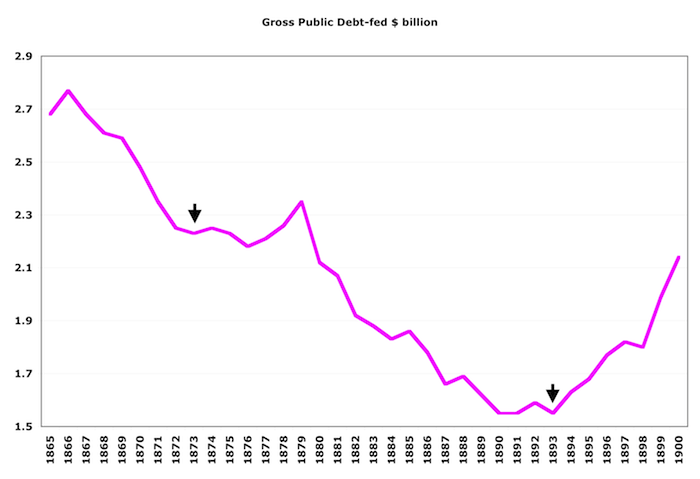

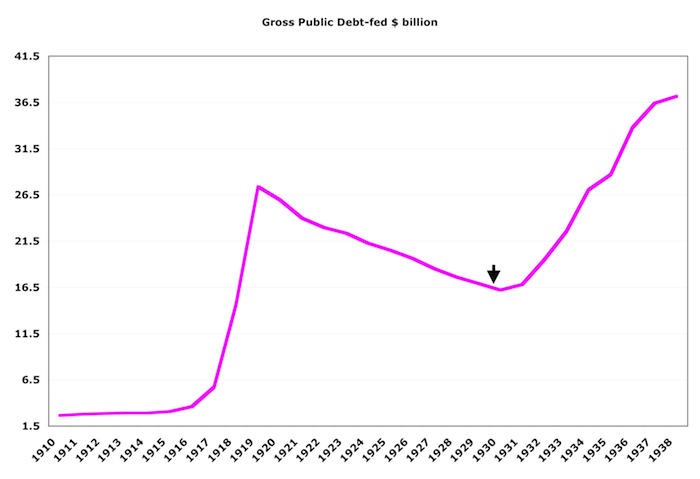

Since 1776 there have been six periods of substantial budget surpluses and significant reduction of the debt. From 1817 to 1821 the national debt fell by 29 percent; from 1823 to 1836 it was eliminated (Jackson’s efforts); from 1852 to 1857 it fell by 59 percent, from 1867 to 1873 by 27 percent, from 1880 to 1893 by more than 50 percent, and from 1920 to 1930 by about a third. (Thayer 1996) The United States has also experienced six periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929.

This all to support the Modern Monetary Theory theory that government creates money through deficit spending (spending creates money, taxing destroys it), and that a growing economy requires more money — hence more deficit spending by government. (Whether those deficits are “financed” through borrowing/bond sales is something of a side issue now that we’re off the gold standard; government could just issue dollar bills instead of T-bills.)

Wray cites a two-page, unsupported (by citations) 1996 article by Frederick C. Thayer. Let me encapsulate it for you:

| Debt Decline Years | Debt Decline | Depression Start |

| 1817–1821 | 29% | 1819 |

| 1823–1836 | Debt eliminated | 1837 |

| 1852 to 1857 | 59% | 1857 |

| 1867 to 1873 | 27% | 1873 |

| 1880 to 1893 | >50% [57% per Thayer] | 1893 |

| 1920–1930 | Approx 33% [36% per Thayer] | 1929 |

That’s enough to make a fellow think. But I’m from Missouri, so I wanted to see the numbers for myself, and in graphical form.

There are a lot of ways to characterize government debt, of course — nominal or inflation-adjusted, total or per-capita, or as a percentage of GDP. Wray and Thayer seem to be talking about nominal totals, which in MMT thinking is the quantity of existing dollars. Here’s that, zoomed in on various periods so you can see the changes (I’ve marked the starts of depressions with arrows):

Source: usgovernmentspending.com.

This seems to bear out what Wray and Thayler say. Every depression was preceded by a big decline in nominal Federal debt. It suggests that a decline in federal debt is a necessary (though obviously not sufficient) cause of depressions.

But what about post-war, and in particular our recent (near-)depression?

First, we have to shift from gross to net debt, a.k.a. debt held by the public, which subtracts money the government owes itself (to the social security and medicare trust funds, and especially recently, to the Fed) to give comparable numbers.

The rabid tea-partier who runs usgovernmentspending.com notably doesn’t share net debt figures (wouldn’t want to spoil the story…), so rather than go dig it up elsewhere I’m going to punt and let Wikipedia give us the picture:

We saw a downturn in nominal debt leading up to the dot-com crash. Otherwise the trend has been flat to increasing.

What all this ignores, of course, is privately-issued debt, something that — confusingly to me — many MMTers don’t talk much about, if at all. I haven’t clarified my thinking on that issue, so I’m going to pass you for the moment to Rodger Mitchell. I haven’t thought through his ideas or data carefully, but I find it useful that he looks at private debt, federal debt, and their relationships over time — something I haven’t found well done elsewhere.

Comments

29 responses to “Does Reducing the Federal Debt Cause Financial Collapse?”

You also might be interested in “The single, most misunderstood fact in economics” at http://rodgermmitchell.wordpress.com/2011/07/19/the-single-most-misunderstood-fact-in-all-of-economics-it-will-blow-your-mind/

Rodger Malcolm Mitchell

You may also want to look at a series of posts done at http://newarthurianeconomics.blogspot.com

Particularly his series of articles comparing Federal Debt and private debt starting at “Debt Relatives”

I don’t have the link anymore, it’s been a while, but one of the commentators re MMT – unlike us who live in Missouri but lives in France, of all places – put the point about debts and deficits directly thus: The Pile of Debt issued by the Sovereign IS the pile of gold that replaced the gold behind the dollar before it was no longer convertible on demand (so going off the gold standard when Nixon was Pres was acknowledging the facts long established.) When you destroy debt, you destroy gold.

Of course, the goldbugs will insist the analogy is false, as 1) if one had a gold standard and 2) some of it just magically disappeared, then 3) relative prices would all re-adjust …

But real gold doesn’t just magically disappear, yet fiat currency, and so the debt issued for it, can in fact come and go as the issuer determines …. barring your (and mine also sometimes, it comes and goes) processing glitch re private debt …. which generates its own money supply…. as the Fed Res credits reserve accounts ….which gets back to the distinction that MMT people still insist is a real one: Debts between PRIVATE persons all sum to zero, no matter how big the numbers. ONLY the Sovereign can create – ex nihilo if you will – NET assets for the private sector … (qualification re balance of trade/accounts withstanding.)

Cold fusion, perpetual motion machines sucking power from free electrons in space…yep, those are the doubting connotations in the back of my mind….

Fortunately for me, I dispute there’s much scientific about economics. Any economic scheme works, for somebody. So I seek the just and morally defensible one. MMT people seem to actually give a shit about what happens to labor – as distinguished from all the people who say they do but never met a minimum wage or labor law they could tolerate.

It seems to me things were qualitatively different, back when you could bring a bag of gold to the mint and they had to turn it into money for you. Different than things are now. It seems it would have been more difficult for federal-budget-balancing efforts to result in depressions.

Anything that drains money out of circulation — foreign trade, domestic saving, and budget-balancing efforts alike — can curtail economic activity and contribute to a downturn. The Robin Hood story captures one solution to the problem of over-balanced budgets. And (I may have noted this before) dragons sleeping on their hoards of gold is imagery that conveys a problem comparable to medieval princes whose treasuries absorbed the medium of exchange, hindering trade and economic progress.

I have no problem at all with “the Modern Monetary Theory theory that government creates money through deficit spending”. I can do the same thing.

But I have a huge problem with their oversimplifications

“(spending creates money, taxing destroys it)”

MMT argues that money is “destroyed” when the federal government receives it, and “recreated” when they spend it. I say that’s complete nonsense. It is a fabrication they think they need to make their argument work. They are wrong.

Art

ps, Thanks Clonal!

I consider myself to be relatively knowledgeable on these things but MMT is slightly murky to me still. I got the idea before it’s modernized version of Keynesianism?? What is considered the archetype book on this??? I mean the King James version of MMT??? Can someone (preferably Mr. Roth) humor me with an answer on this??? Stiglitz is the current torchbearer of the MMT???

It’s 6am my mind isn’t awake enough to take this post in yet, but I like these more meaty posts with the graphs, looks like a good one Steve.

@Ted K Ted, you wouldn’t go far wrong by starting with the Wray chapter linked above. Also Warren Mosler, Bill Mitchell, New Economic Perspectives, Real World Economics Review, Steve Keen.

@Dave Raithel “Debts between PRIVATE persons all sum to zero”

This is one of the things I’m pondering mightily. The whole “neutrality of money” bit seems to be rooted at least in part in this thinking. But even adopting the notion of zero net, doesn’t massive gross (with massive flows of gross in different sectors constantly shifting balances) result in really big effects? Seems to. And of course there’s no such thing as zero gross in a money economy, because the only way to store money (except cash in a mattress) is to lend it to others.

@The Arthurian “MMT argues that money is “destroyed†when the federal government receives it, and “recreated†when they spend it. I say that’s complete nonsense. ”

It actually makes a lot of sense to me — along with the idea that there’s no such thing as government savings, which destroys the S=I accounting identity. I also think it’s oversimplified — as I said here, it doesn’t address the issue of money creation through private credit issuance. Some — Keen, Bezemer, et al — are groping towards a more integrated theory, I think.

I’m liking your work on fed vs private debt. Though I think the right measure of fed debt is gross minus SS/Medicare/Etc. trust funds *minus govt debt held by the Fed.* Would like to pull some correlations on different measures of that, vis a vis private debt outstanding, and their relationships to GDP growth, unemployment, etc. Will try to get to that soon.

Hey Steve,

I just skimmed it like super fast. Still haven’t read it like I should, but this and the Wray link are at the top of my “to do list”. Here was the thing that jumped at me on the blurred skim through—–“Bastard Keynesians”. I’m trying to think if I ever saw the word bastard in an academic footnote. I’m thinking as horrid as my memory is, I would recall that. When I think of guys like Eric Cantor, some how the term “Bastard” (capitalized of course, as Wray did) seems technically sound and wonkily accurate.

“Keynesian Bastardizers” would be a more accurate description?? Still I’m not against calling Eric Cantor a bastard, so I defer to Wray’s academic judgement……

OK, I’m gonna ask the stupid question: What do the gold bugs think will happen to all the US fiat currency debt that exists at the time of switching to a gold standard? Will it magically disappear by default? Or, will we have to pay the creditors with our gold reserves? Not a very promising prospect, I suppose.

@Ted K I think “bastardized Keynesianism” describes it well. A.k.a. Keynsianism without the Keynes.

@nanute Sorry, I have no idea. Will ponder, though…

I don’t see the gold standard coming back myself. It’s just not practical. We’ll end up paying most of the debt in devalued paper currency (Dollars).

I think probably what will end up happening is SDRs will very very slowly become the dominant thing. There are many “experts” to read on gold standard, and in my opinion many of these “experts” are just white noise or static (Peter Schiff is one who is like nails on chalkboard to me). The guy I like very very much on this topic is Barry Eichengreen (I have two of his books and I only got 1/2 through one of them, not ‘cuz it’s not really great knowledge or boring, but because I am lazy so and so). There are other good ones.

Nanute, I think your question is a very very good question and very worth tackling. I hope Mr. Roth will tackle it when he finds time.

@Ted K

Thanks Ted. I can’t believe that no one has even stopped to consider the question.

“But even adopting the notion of zero net, doesn’t massive gross (with massive flows of gross in different sectors constantly shifting balances) result in really big effects? Seems to.”

Yes, and the rules of the game (how much capital must private lenders have, how many parties can stand in a line to collect interest on MBSs and all varieties of derivatives, what has to be traded on exchanges – all the things raised in the finance reform law) direct effects, more or less…

At the risk of “bastardizing” everything I’ve read and can recall in as brief a space as possible, and at the risk of “conflating” all sorts of distinctions others will make, this is the sense I try to make of MMT and its relation to the REAL economy:

1. Like Minsky (Wray’s dissertation director? I believe…), the MMT people accept that capitalism is inherently (endogenously) unstable. Equilibrium theory is false. The neo-classical pipe dream to explain all macro-economic events by reduction to micro-economic events is just that: a pipe dream. (You’ve been watching the Keen videos, so you know the time he takes to dispute the “rational” foundations of the program.) The belief that capitalism is unstable does not follow from any specific theoretical commitment – Keen has a paper from years ago arguing against Marx’s labor theory of value as an explanation – but rather, it’s just the fact: Look at history and your own experience.

2. But politically, socially, morally, epistemologically, etc, some form of capitalism is what we are going to have.

3. So the issue is to design finance policies and practices that make capitalists put finance into real investment and not more finance investment. (That Gecko distinction between “making” and “owning.” MMT people and their allies, like Michael Hudson, emphasize they oppose rentiers – a significant point for me contra the “libertarian” indifference, or disbelief, that rentiers exist, or that there is something wrong if they do. But they are indifferent or disbelieve that asymmetry matters, or that there are negative externalities that cannot be solved by meditating upon the Coase Theorem.)

4. There’s no certain foresight about those practices, any more than there is certain foresight about what capitalists do even with real investment, no more than there is certain foresight about anything empirical (and few things formal, actually. The best “model” for knowledge is “aporia”, not probabilities approaching certainty.)

5. So, all we can ever do is approximate and move on. When the real economy is more or less approaching (but never reaching) EQ – there are few unused capacities, low (as in old fashioned 3%) unemployment, etc., the Fed Gov doesn’t have to do much. What deficits it may run year to year mostly function to set a floor on interest rates and as a haven for “risk averse” savers. A “balanced” budget means that the Fed Gov is running as a utility, providing public goods that the private sector won’t deliver. (So when it is running a deficit, it is delivering public goods that the private sector CANNOT deliver – though this course a theoretical point I’ll eventually get to, as obviously some of the deficit goes to people with a lot of stuff who want even more…)

6. When things get really whacked, then the Fed Gov buys – with the tokens it manufactures – that labor and unused capacity – otherwise we get the Fischer debt-recession cycle. (It does not have to “borrow” anything.)

7. As capitalists recover, as some “reorganization” of the real economy happens (business will still fail, there will be bankruptcies, etc., but short of catastrophic) then the Fed Gov can step away.

8. If the Fed Gov overshoots and there is bona fide inflation (in the old fashioned sense of “too many dollars chasing too few goods” and not in the sense of “demand pull”) then it can/should/but will it? raise taxes. In fact, the point of MMT that MOST intrigues me is that since the Fed Gov needs NO taxes to fund itself, the real effect/purpose of taxes is to redistribute purchasing power – to regulate aggregate demand. (So contra our previous exchange re SS/Fica taxes should be levied on all sources of income, with no cap, Warren Mosler did once reply to a question I put at NEP that when/if I grasp MMT in full, I’d reject that contention.)

9. That pile of debt the Fed Gov has is an historical legacy, a fetish, a residue of past practices. It is at best and at most an accounting record of past purchases, and it is OWED to no one. Well, for historical reasons we think it is owed to the Chinese, or some pension fund that is still underfunded and will need bailing out by the PBGC, but these are practices required for political and cultural reasons, not by the actual mechanics of whatever kind of capitalism we get/have.

Now, that’s probably an 8th grade level exposition of MMT, but I think it is coherent. It doesn’t explain a lot of things that I wonder about, like one of my favorite questions: Why/how did capitalists not pay workers increasing wages as productivity went up, but instead figured out how to loan workers money to put them into debt to buy the consumer goods they made for capitalists?

It is also an exposition emphasizing what its proponents tend to understate – for their own reasons, I am sure: the overtly political aspect of putting the theory into practice. People who enjoy examining the byzantine relations of the Fed Res to Wall Street and banking direct their attention to technical/causal/accounting questions, but those questions would all be, as I can understand them, relative to the actual rules in place for negotiating one’s way through those relations.

But I try to grasp MMT more as the social/political “philosopher” and as one who – as I’ve mentioned – disputes that economics is very “scientific.” Like some of the people over at RWER occasionally say, there is no single, unified theory of economics – not yet anyway – what we have are different KINDS of economies that have to be studied as institutional and cultural practices, and they will vary as much as environmental niches vary taxonomies.

So to the extent that MMT is a “general” theory of how sovereigns create money and how sectors must balance, etc., the purposes to which deficits are put will have different effects relative to the political/social powers in the community. IT IS THAT which, I suspect, will be/is the source of most the animus towards it – all those who insist that there is a true science of economics (see 1 above) and things would be fine if politics never intervened …

Good luck with THAT….

Sorry, been on vacation with my daughter. Very nice writeup, Dave. I’ve only read it once so far, but I think I agree with everything I read. Yeah: human progress has been a steady but decidedly fitful motion toward more equitable distribution, fought every inch of the way by a large portion of those at the top. MMT inherently suggests that that progress should continue, no matter how much its proponents try to suggest that it’s simply a scientific description. (Though it is also a much better one of those than we’ve had in the past,IMHO.)

I don’t know about ‘animus’ Dave, but I have a word on your #8:

“In fact, the point of MMT that MOST intrigues me is that since the Fed Gov needs NO taxes to fund itself, the real effect/purpose of taxes is to redistribute purchasing power…”

The greatest weakness of MMT is that it throws away everything and starts anew, reversing many of the relations from what they are in the world apart from MMT.

For me, “the Fed Gov needs NO taxes to fund itself” is one of those start-anew concepts, and from my perspective it is an assumption until proven otherwise. (And the proof is not that I or anyone “grasp MMT” but that it be implemented and survive for a hundred years. So that’s a ways off yet…)

Given my view that the “the govt doesn’t need taxes to fund itself” is just an assumption, I react badly when the concept is buried in the middle of a sentence and after the word “since”. I have great trouble with such constructions and what they attempt to convey.

What was the other thing?? Oh, yeah, your number nine, re debt:

“these are practices required for political and cultural reasons, not by the actual mechanics of whatever kind of capitalism we get/have.”

Required is required. If there are political and cultural reasons to borrow rather than print, and to record the borrowing as debt, then those are the reasons. They would fall under “human nature”, which is one of the “givens” in *any* economic system.

A

Yeah: human progress has been a steady but decidedly fitful motion toward more equitable distribution,

I’ve been on vacation too, with 8 of my grandchildren, so I’m way out of touch.

Steve – I think your quote does encapsulate a real struggle. However, I wonder why you think there is steady motion toward equity? Certainly that was true post WW II until Reagan. Since then, we have had a steep increase in economic inequality, which is currently getting a hell of a lot worse. Reduced progressivity in tax policies and deregulation have certainly played a part. But I think the real change is in what these things have enabled. (see below.)

Dave – Very informative — thanks! What is missing (unless I missed it) from the MMT discussion is exactly the issue of distribution. The key is in your Pt 3, I believe. Since WW II, corporate profits have grown at an increasing rate – while GDP since 1980-ish has grown at a decreasing rate. Meanwhile, finance sector profits have grown from about 20% to about 50% of total corporate profits.

http://jazzbumpa.blogspot.com/2011/06/where-has-all-money-gone-part-151-even.html

This represents a dramatic growth in rentier-like activities – and I include all finance (rather than real) investment, such as commodity speculation and the stock market in that category – and derivative instruments multiply so.

Progress toward equitable distribution arced up for a few centuries, as rent collection was replaced by profits as the economic engine: the climb up from feudalism to the industrial revolution. That is now being reversed as rent collection is replacing profits – and its happening over decades, not centuries.

Economics is the flip side of politics. Politics is the manipulation of power. This is why the struggle towards equity is so vigorously resisted by those at the top.

Economics is truly dismal, but because it is joined at the hip with politics, it can never be a science – or even a field of honest, rational discourse.

Alas,

JzB

@JazzBumpa “I wonder why you think there is steady motion toward equity? Certainly that was true post WW II until Reagan.”

I’m talking globally, and over centuries. We’ve had a big setback in recent decades, and in fact in recent days.

@Ted K Yes: my comment re: Neville Chamberlain (wherever that was — rortybomb?) related to Obama’s negotiation and gullibility in the budget cap battle.

Steve –

I was assuming that from medieval times through the industrial revolution and beyond, there had been the steady motion towards equality that you mention. Bruce Webb just put up a post at AB that makes me question that assumption.

http://www.angrybearblog.com/2011/08/chayanov-domesday-and-eight-ox-team.html#more

Was a 19th century mill worker in a more favorable position than an 11th century serf?

Granted, that is too narrow a focus. But can we really say with any confidence that equality has been on the march for the last couple of millennia, worldwide? I really don’t know.

Cheers!

JzB

[…] Do you notice our progenitors’ great-great-grandchildren (us) paying off our forebears’ debts? Yeah, neither did I. (It did happen once, and the result was economic catastrophe. Every depression in our nation’s history was preceded by a big decline i….) […]

[…] Do you notice our progenitors’ great-great-grandchildren (us) paying off our forebears’ debts? Yeah, neither did I. (It did happen once, and the result was economic catastrophe. Every depression in our nation’s history was preceded by a big decline i….) […]

[…] Do you notice our progenitors’ great-great-grandchildren (us) paying off our forebears’ debts? Yeah, neither did I. (It did happen once, and the result was economic catastrophe. Every depression in our nation’s history was preceded by a big decline i….) […]

[…] I confirmed it […]

[…] periods of depression. The depressions began in 1819, 1837, 1857, 1873, 1893, and 1929. And I confirmed it (graphs): Every depression in U.S. history was preceded by a big drop in nominal Federal […]

[…] while back I pointed to (and demonstrated with not very pretty pictures) Randall Wray’s rather stunning observation: every depression in American history was […]

[…] while back I pointed to (and demonstrated with not very pretty pictures) Randall Wray’s rather stunning observation: every depression in American history was […]

[…] If he is correct that the supply of dollars is, has been, insufficient to meet global demand, then inflation is not currently a concern — arguably quite the contrary. […]

[…] If he is correct that the supply of dollars is, has been, insufficient to meet global demand, then inflation is not currently a concern — arguably quite the contrary. […]

[…] (six hundred years combined), the U.K. and the U.S. governments have paid off their debts exactly once: the U.S. in […]

[…] (six hundred years combined), the U.K. and the U.S. governments have paid off their debts exactly once: the U.S. in […]