Modern Monetary Theory has been revolutionary in economics, and its influence is — beneficially — ever-more pervasive. It has opened the eyes of a generation to a clear-eyed, accounting-based methodology that trumps dimensionless theory, and has brought a deep, nuts-and-bolts understanding of money, debt, and financial institutions to a discipline where that understanding has been inexcusably absent. Witness: a whole raft of papers from central-bank economists worldwide embracing MMT principles (though often not MMT by name), and eviscerating decades or centuries of facile and false explanations of monetary mechanisms.

But MMT’s terminology and associated accounting constructs remain problematic and contentious, even among some MMT supporters like the splinter group, the Modern Monetary Realists. Some of this contention results from the usual resistance to new ideas and ways of thinking. But some arises, in my opinion, because MMT terms and accounting constructs are indeed problematic. (The terminological confusion even causes some to object correctly, but for the wrong reasons — and vice versa!)

These difficulties are apparent when you consider one of MMT’s central and oft-repeated mantras and accounting identities, here in its simplified form for a closed economy ignoring Rest of World, courtesy of the redoubtable Stephanie Kelton:

Domestic Private Surplus = Government Deficit

This suggests an important truth, as far as it goes: public (monetarily sovereign federal government) deficit spending creates private assets out of thin air. The government spends new money, created ab nihilo, into private accounts. +Private Assets. No change to private liabilities. So: +Private Sector Net Worth.

But it doesn’t actually go very far. That “private surplus” (a term that is absent from the national accounts, and from MMT’s ur-text, Monetary Economics by Godley and Lavoie) is not defined in accounting terms, except circularly and tautologically: it’s the amount that private assets increase as a result of government deficit spending. That makes the identity true by definitional tautology.

But contrary to what’s at least implied by the equal sign, deficit spending is not the only way that private assets increase, or even the primary way. It’s not the only source of private-sector “surplus” or “saving,” as is often suggested in MMT discourse. Not even close.

Start by thinking in terms of Household Net Worth. This measure has the virtue of encapsulating and telescoping all private-sector net worth, because households ultimately own firms, at zero or more removes, but firms don’t own households (yet…). Citibank may own some GE shares, but Citibank is ultimately owned by households. Because: firms issue equity shares; households don’t. It’s an asymmetric, one-way ownership relationship.

Then take a look at this paragraph from MMTers extraordinaire Eric Tymoigne and Randall Wray:

MMT does differentiate between saving (in the flow of funds it is the change in net worth: ΔNW) and net saving (saving less investment). Net saving shows how the accumulation of net worth occurs beyond the accumulation of real assets. For the domestic private sector, this comes from a net accumulation of financial claims against the government and foreign sectors.

Some of the problems with this paragraph:

• Pace T&W, there is no “saving” measure in the Fed’s flow of funds accounts (FOFAs) that equals ∆NW — whether you’re talking net or gross saving (with or without consumption of fixed capital), including or excluding capital transfers.

• The “net saving (saving less investment)” bruited in that paragraph is confusingly at odds with the existing definition of the term as used in the national accounts — gross saving minus consumption of fixed capital.

• “Net accumulation of financial claims” does not appear anywhere in the national accounts, and has an uncertain relationship with a measure that the FOFAs do provide: “Net acquisition of financial assets.” Are these the same measures? If not, what is their accounting relationship?

I find here a set of terms that I’m unable to resolve into a coherent set of accounting statements — despite years of diligent and highly motivated efforts to do so. (I’m an ardent MMT supporter; I wouldn’t be thinking these thoughts if it weren’t for the MMT cabal.)

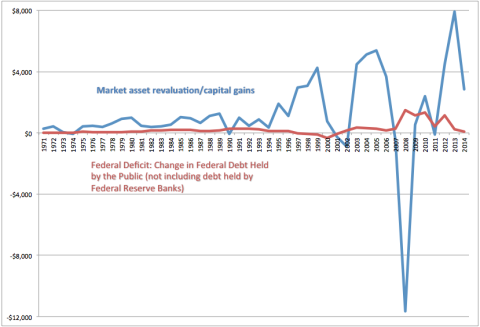

The core problem is these measures’ opaque relationship to net worth, and change in net worth. The problem exists because they don’t incorporate the primary way that net worth (wealth) is accrued: market revaluation of existing assets, a.k.a. capital gains. Market runups increase private-sector assets, without increasing liabilities. Voila: higher private-sector net worth. “Money” created, ab nihilo.

MMTers seem to have these conceptual, terminological problems for the same reason as more traditional economists (and due to MMTer’s efforts at speaking in those economists’ language): they’re still “thinking inside the NIPAs” — despite MMTers well-founded devotion to the FOFAs.

The BEA’s National Income and Product Accounts, pioneered by Simon Kuznets in the 1930s, are essentially income statements. They are one of the primary data sources for the FOFAs. But the NIPAs have a key failing: they don’t include balance sheets (the essential second component of a coherent accounting, which the FOFAs add). And the NIPAs completely ignore (with good reason) existing-asset exchanges and revaluations.

Absent balance sheets, and accounting for existing-asset revaluation, it’s impossible for balance sheets — and net worth, period to period — to…balance. Economists who don’t deeply understand that — and I will assert that few economists do, because they’re conceptually trapped inside the NIPA’s balance-sheet-free definitions of income and saving — cannot form a coherent understanding of an economy’s workings.

In Monetary Economics, Godley and Lavoie (G&L) do show a deep understanding of revaluation’s importance — they give extensive coverage to the Haig-Simons accrual-based mark-to-market accounting approach that I also favor. But you’ll be hard-pressed to search Google for top MMT names (Wray, Tymoigne, Kelton, Fullwiler) and find asset revaluation, capital gains, or Haig-Simons accounting incorporated into their discussions of income or saving.

This even though the FOFAs (presented in the Fed’s Z.1 reports) provide exactly that: balance sheets and income statements based on Haig-Simons accounting — using accrual-based, marked-to-market revaluation of existing assets — wherein the sum of accounted flows totals to balance sheets’ period-to-period net worth changes. See for instance the Household tables B.101 (bottom line: net worth) and R.101 (top line: change in net worth).

Those FOFA tables are the source of the Integrated Macroeconomic Accounts for the United States (IMAs), which unlike the NIPAs, conform (mostly) to the international System of National Accounts (SNAs). See for instance Household table S.3.a, which includes the income statement and balance sheet on a single page (bottom line: net worth).

You will find a similar Haig-Simons approach in Armour, Burkhauser, and Larrimore 2013, an analysis that merits significantly more attention, and replication. (The authors, inexcusably, have not made their data set available.) The FOFAs and IMAs provide the necessary revaluation estimates for such a replication, estimates which Armour et. al. achieve by their own methods (somewhat different from the Fed’s, but using similar indices).

This is all important because the widespread MMT statement (at least implied, and frequently explicit) — that government deficits are the source of private saving (or “surplus”) — is at least a poor explanation of economic workings, and at worst just wrong. Government deficits are a source of private saving.

The two primary sources of private assets (hence saving) are:

- Surplus from production (how “surplus” is commonly used in the national accounts), monetized by the markets for newly produced goods and services.

- Revaluation of existing assets — assets produced in previous periods — realized in the existing-asset markets.

I would even go so far as to say that these are the primary mechanisms whereby “money” is created. Deficit spending is small beer compared to cap gains. Asset markets go up, and there’s more money. This eschews the widespread confution of money with “currency-like things,” suggesting rather that all assets — which since they exist on balance sheets are necessarily designated in a unit of account — embody “money.”

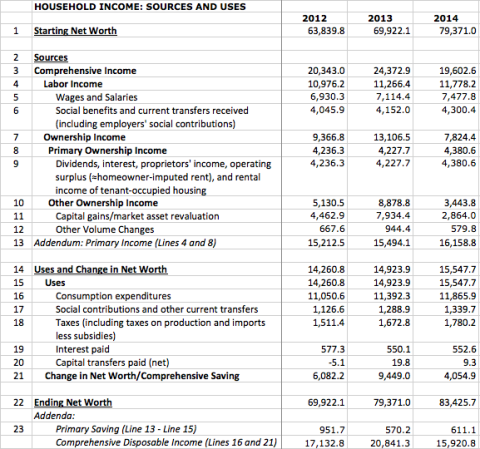

As an aid to untangling the confusion that I still find inherent in MMT discourse, I offer up the following taxonomy of sources for household income. It’s explained in detail here.

| Household Income Sources | |||

| Comprehensive Income (gross contributions to net worth, before netting out expenditures) | Non-Property Income (compensation for labor) | Other Labor Income | Social benefits and other transfers received (including employers’ social contributions) |

| Primary Income | Primary Labor Income: Wages and salaries | ||

| Comprehensive Property Income (compensation for ownership) | Primary Property Income: Dividends, interest, proprietors’ income, rental income, and operating surplus | ||

| Other Property Income | Market asset revaluation (capital gains) | ||

| Other changes in asset volume | |||

Here’s what that looks like in an accounting statement, here using IMA data:

Before you raise objections, I point you again to further explanation of this construct, here.

Like Armour et. al., I use a measure labeled “Comprehensive Income” that includes accrued, marked-to-market capital gains. I go a step further, however, and propose another measure based on that, a residual of sources and uses: “Comprehensive Saving.” That measure has a singular virtue: it equals change in net worth.

“Primary income” — the vestige of the NIPA’s “income” measure that is carried over into the FOFAs and IMAs (but properly labeled as “Balance of primary incomes”) — is given as an addendum measure. The measure here varies from the FOFAs/IMAs only in that interest paid is not deducted from income; it’s tallied under Uses.

Comprehensive Saving does not, of course, equal government deficit spending. (Nor does Primary Saving.) Such spending contributes to private-sector saving, but it’s not even vaguely identical.

Before concluding, I’d like to touch on private-sector bank lending. (Modern Monetary Realists, are you listening?) Its direct effect on net worth is zero. It creates new assets — bank deposits. But unlike government deficit spending, it also creates equal and opposite offsetting liabilities on both the borrower’s and the bank’s balance sheets. Both balance sheets expand, equally on the left and right sides.

Borrower: +Assets (new bank account deposits) +Liabilities (new loan payable)

Bank: +Assets (loan receivable) +Liabilities (customer deposits withdrawable)

So the act of private lending itself creates new assets, but it doesn’t directly, in accounting terms, increase private-sector net worth.

But: borrowers use many of those loans to create real assets — goods, capital — that are then sold at a higher value (or marked to market at a higher value). That markup increases private sector net worth, and private lending is a huge catalyst for that process. But that is an economic effect, not an accounting identity.

So yes: private bank loans create new private-sector assets, and they have the indirect economic effect of increasing net worth, but they don’t, directly and in and of themselves, increase private-sector net worth. Government deficit spending does. MMTers are right that it’s special in that way.

What they’ve missed — or caused many of their followers to miss — is that it’s not the only thing that’s special in that way.

Really, it’s not even close:

Runups in stock and real-estate markets create new wealth, net worth, “savings,” money, out of thin air — just like deficit spending, but by a different mechanism.

The markets create money too.

Cross-posted at Angry Bear.

Comments

79 responses to “Where MMT Gets Its Accounting Wrong — And Right”

The identity Domestic Private Surplus = Government Deficit can be derived from NIPA and Flow of funds. Of course the flow of funds will involved asset revaluations in this and saving definition is different. MMT does not dispute that

In NIPA we have S – I = G – T

IN FOFA we have NFAdp = – NFAg

MMT does not look at reevaluation is incorrect:

– Check Tymoigne and Wray work on Minsky (book called “the rise and fall of money manager capitalism” goes in great deal in explaining that the rise in households’s net worth based on rising home prices was required to sustain their growing debt. That’s Ponzi finance).

– It is a matter of focus. If the goal is to look at government-private sector interactions in income terms then reevaluation issues are not the focus point.

Regarding change in NW and saving. again this is balance sheet account: NWt = NWt-1 + S. Ritter’s “An Exposition of the Structure of the Flow-of-Funds Accounts” S is precisely that and S will change with changes in asset and liability valuation.

Quote””Net accumulation of financial claims†does not appear anywhere in the national accounts, and has an uncertain relationship with a measure that the FOFAs do provide: “Net acquisition of financial assets.†Are these the same measures? If not, what is their accounting relationship?” Yes they are the same.

I am not sure what the aim of your post is.

If you really want to say something about national accounts, keep MMT aside. Just don’t bring their confusions in.

Once you get rid of it, you’ll feel free.

🙂

You’ll forever hide from simple facts and keep claiming that bank lending doesn’t create private net worth. I swipe my credit card at a store and private net worth increased! It’s as much an accounting effect as an economic effect.

OTOH, let’s say the Indian government buys a fighter plane from the US government. No rise in India’s net worth while government deficit has risen.

You cherry pick a few cases and claim strange things.

It’s of course true that fiscal policy has a HUUGE role to play but avoid counterproductive ways of saying these things.

You’ll be dismissed even in accounting (which you claim to be a strong point) such as as done here by Murphy. https://mises.org/library/upside-down-world-mmt

Robert [Murphy]: “In particular, I think it is crazy when people say that if the federal government runs a budget surplus, then by simple accounting the private sector can’t save.”

Steve, didn’t we cover all of this three years ago? This was the whole point of S = I + (S-I). JKH probably wrote several books on the concepts being discussed. Several MMTers decided not to understand it, but I am surprised you’re still revisiting this.

The whole point of that discussion was to emphasize that the govt is actually a much smaller player in all of this than some people imply. And when you link the pieces of that equation you realize that taxes don’t “drive” money. There is no money “monopolist”. The private sector doesn’t “leverage” NFA. Basically, MMT has huge holes in it.

[Puts on flame retardant suit in anticipation of many angry comments and promptly leaves room]

Yes Cullen there is a currency monopolist (MMTers dont say money monopolist, nice strawman), and yes it is the Federal Govt. Sorry to disappoint your ideology.

And yes the private sector does in fact leverage NFAs, as TSY CDs are a huge source of collateral in lending. Again, sorry to disappoint your ideology.

“MMTers dont say money monopolist, nice strawman),”

That’s a blatant lie Auburn Parks.

Paper title: “Monopoly Money: The State as a Price Setter”

Pavlina R. Tcherneva

Quote: “The government becomes the “money monopolistâ€

Great Post Steve.

I really enjoy your constructive criticisms of MMT doctrine. Question everything is usually the best philosophy.

My personal belief is that the importance of the NFA is different than you’ve portrayed it here. Yes, its limited because it is specifically limited to Govt IOUs, which even at ~$20 Trillion is just a small part of the entire US dollar economy worldwide. So while its true by definition and somewhat small in comparison to the whole (in nominal dollar terms, hell Fedwire settles $2+trillion a day!), the importance comes from the exogenous nature of fiscal policy. For example, there are many ways to boost private sector activity via macroprudential policy, but the results are conflicted. We could definitely increase home lending and thus construction by allowing then promoting no down payment mortgages, but is that the best way to increase spending and construction?

On the other hand, because fiscal policy expansion always creates NFAs, the two things are synonymous. So to say that the level of NFAs being created is too low is simply to say that the deficit is too small. So much so obvious. IMHO MMT harps on fiscal policy because they view it as the best way to increase aggregate demand, incomes, and wealth.

Yes, we could use monetary policy, QE and zirp has definitely increased the wealth of the private sector. But what has that accomplished except to exacerbate income inequality.

Yes, we could use regulatory policy. The financial deregulation policies of the late 90’s definitely led to increased private sector wealth as oil went to $140 a barrel when non-end users were allowed and encouraged to speculate in commodities markets. Allowing financial institutions to on-sell their loan assets to third parties definitely increased the number of loans made. But has any of this been an unambiguous net positive for society? I think the GFC proved that these arent good ways to increase spending via private credit expansion. Im sure we could all put our heads together and come up with changes that would indeed be a net positive, but thats not what has happened in the real world.

Now on the other hand, increasing private sector incomes via a FICA suspension or increased employment via infrastructure spending is a direct, simple, unambiguous good for society when we have lots of spare capacity. In this sense, MMTers focus on NFAs = fiscal policy because its by far the most effective and direct method for effective macro-economic outcomes. I humbly believe that this is obvious.

There is no downside to providing free university education with no tax revenue offset.

There is no downside to providing an employed buffer stock of employed labor instead of our current policy of maintaining 15 million unemployed people and all the bureaucracy that entails as an inflation anchor.

There is no downside to suspending FICA when demand is too low

Again, great article Steve.

@Ramanan

Can you really be this dishonest?

The paper is written exclusively in terms of either currency or “state money”. That must have been a pun for the title.

Just look at the chapter titles for crying out loud:

2. Colonial Africa: An Introductory Model of a Tax Driven Currency

3. Further Historical Examination of State Currency

Here is her opening paragraph for the readers here at this blog that wont check the link. Just so you can get a sense of Ramanan’s dishonesty or ignorance:

“Today’s currencies exist within the context of State powers. These powers endow

the State with the ability to move desired resources from the private to public sector using

economic policies targeting full employment and price stability. This paper explores the

basis for understanding modern monetary systems as rooted in the monopoly powers of

the State. In the first section, the case of colonial Africa will be used to demonstrate how

State powers are used to give value to the currency. The second section further explores

historical issues in the development of these powers and their institutional basis. The

present-day monetary system and the role played by the government are then examined.

In particular, the way in which certain powers of the State turn bank money into State

money is explored in this section. This third part is intended to alleviate any doubts with

regard to the government’s monopoly powers in the presence of bank credit creation. In

the fourth part, a mathematical framework is employed to demonstrate the exogenous

pricing power of the State. Finally, a conclusion is offered in which the employer of last

resort approach is identified as an appropriate policy framework for full employment and

price stability.”

Now please provide the actual body of her paper where she or any MMT academic ever says that the state is the money monopolist. which is why MMTers regularly claim that anyone can create money. Its just an IOU. But only the Govt can create STATE money aka currency.

The monetization of “market revaluation of existing assets, a.k.a. capital gains” does not happen in a vacuum. Careful examination reveals taxation by lottery

Nice try, Auburn.

Except that even after the inclusion of the banking system she has the claim about “money monopolist”

But if aren’t satisfied title of the post by Wray.

http://neweconomicperspectives.org/2009/08/money-as-public-monopoly.html

Ramanan, yes that paper’s verbiage is over the top from Wray, IMHO. That doesnt make Cullen’s or your comment any more dishonest since you both were clearly referring to a general MMT claim, which is demonstrably false.

@Ramanan

Pavlina’s paper speaks for itself. I cant believe how dishonest you are.

Hi Auburn. Let’s be nice. No need for unpleasantness.

As Ram noted, you’re not right and my comment isn’t a “strawman”. MMT implies that “state money” has some special significance when the reality is that most “state money” exists just to facilitate private sector forms of money. State money doesn’t come “first”, “drive” anything and the national debt isn’t “the equity that supports the entire global credit structure” (as MMT says).

For instance, most currency (cash as I am using it here) exists because bank deposit users swap their deposits for cash. If you want to imply that some govt monopolist issued this to the private sector then be my guest. But that would be a misleading way of describing the flow of funds.

Also, trillions in private sector loans are backed by various financial assets and real assets like gold, real estate or other forms of collateral. So what? Should we start a whole theory based on how these “real” assets are leveraged into various forms of financial instruments?

I’m going to put that flame retardant suit back on now and leave the room, but if anyone reading this is sincerely interested in this discussion you can reach me via email or on my site.

Sayonara amigos!

“paper’s verbiage is over the top from Wray”

Thanks for accepting that MMT is an overkill.

Sayonara Amigos! from me too.

“The markets create money too.”

The land “market” does not create wealth.

It merely redistributes it, from non landowners to landowners in a rent seeking fashion

Money creation through deficit spending and a 100% tax on land values would free up resources such as real estate agents currently used for rent seeking, and is far better than the current system.

@Cullen Roche

Right Cullen. The universal means of settlement is irrelevant. That must mean you believe gold was irrelevant to the economy as well when interbank transactions were settled with gold\certificates.

And yes, your claim that MMTers say the Govt is the money monopolist is clearly false and a strawman. There is no nicer way to describe your dishonesty.

And yes, state money comes first before taxes can be paid and TSY CDs can be purchased, and taxes drive the acceptance of a state’s currency. This is all historical fact, nothing MMT says in this realm is wrong, your ideological biases are irrelevant.

And Yes TSY CDs are a very important source of financial wealth and savings for the entire global US Dollar economy, hell they are a quarter of the entire TCMDO construct.

Ramanan-

In non way do I accept that MMT is overkill, but unlike you, I’m not dishonest enough intellectually to not admit when I think something is wrong. Anytime you would like to acknowledge how wrong you were in characterizing Pavlina’s paper would be fine.

To everyone who’s in these contentions: I’m not. You’re arguing about stuff that has little or nothing to do with this post. I’d love it if folks would read it carefully — especially the accounting construct, and the preceding post explaining that construct — and give me feedback that doesn’t involve longstanding rivalries.

The gist of this post: this confusion and contention is mostly the result of stuck-in-the-NIPAs “income” and “saving” definitions that do not include revaluation/cap gains. I think (twirling my finger in my cheek) that everyone’s talking past each other because those definitions can’t balance with net worth — they’re missing a huge Source of income that contributes to net worth.

And that source is ab nihilo. New (increased) assets appear on the household balance sheet out of thin air, simply because people (now) think existing assets are worth more than they thought (when they were produced).

So we should think about cap gains as income from production — but production in previous periods, so absent the inclusion of revaluation measures there’s no Source in this period. (Unfortunately, all that extra income goes to owners — none to the workers who did that production last year or ten years ago.)

@Eric: sometimes it’s true, it’s a ponzi game. But over the decades and centuries, it’s not. The market regularly realizes that assets produced in previous periods are actually worth more than we thought they were when we priced them in the market for newly-produced goods and services. (This suggests that GDP is seriously underestimating the value of production, and that production-linked (labor) incomes are seriously underdelivered, going to owners in later years instead.)

Thanks very much for Ritter’s “Exposition.” Unfortunately it only touches on cap gains in a footnote, and there only to say that the subject “gives rise to problems”:

There’s no discussion of accrual, mark to market, Haig-Simons, etc. I’d love to see the Robinson response, but vigorous googling hasn’t turned it up.

I will spend some serious quality time with the rest of your comment. Much appreciated.

/@Eric

I’d love to hear feedback from folks on the accounting structure bruited here, in particular the labeled measures of income and saving. I may be delusional, but I think they may go far toward cutting the Gordian knots of contention at play here.

This requires temporarily putting aside “primary income” (hence saving) measures as the only useful ways of thinking about income (and saving). I’m suggesting that they are the very problem. They may be the only useful ways (I question that), but I’d love to hear from folks who have taken an honest shot at fully embracing this view of things, including reading the explanation here:

http://www.asymptosis.com/why-you-probably-dont-understand-the-national-accounts-in-pictures.html

Thanks all,

Steve

Hey Auburn Parks,

Looks like you do not want to understand.

Section: Further Historical Examination of State Currency

Which is not the section about Colonial Africa.

This section briefly discusses some aspects of monetary evolution, in particular

how money became State currency and how the State became the “money monopolist.

Stop it you guys.

“The gist of this post: this confusion and contention is mostly the result of stuck-in-the-NIPAs “income†and “saving†definitions that do not include revaluation/cap gains. I think (twirling my finger in my cheek) that everyone’s talking past each other because those definitions can’t balance with net worth — they’re missing a huge Source of income that contributes to net worth.”

Thanks. So why did you bring MMT in? Time pass?

Oh and are we unenligthened souls Steve? Something you know that we do not?

You can keep writing about it … it’s all counterproductive. I think people you’ve argued with … KNOW VERY WELL that revaluations also appear in these things.

Your only point about this post is to bring revaluations into definitions of income and so on. It has nothing to do with MMT. I think you’ve confused them unnecessarily.

But you’ve mixed it with more unnecessary things such as your points about private lending not increasing net worth directly and so on.

@Ramanan

“why did you bring MMT in?”

Because I think the equals sign in the deficit=surplus thing, the notion that gov deficits are *the* source of private saving, doesn’t represent things properly or at least usefully.

“people you’ve argued with … KNOW VERY WELL that revaluations also appear in these things”

Yeah but they don’t incorporate that into their writings or analyses. They never get mentioned or considered in discussions of income or saving.

Even G-L (all praise) don’t even mention Haig-Simons until page 140, and they don’t start incorporating it until page 290. I think it should right up front, incorporated as “income” from the word go, as in the accounting structure here.

“you’ve mixed it with more unnecessary things such as your points about private lending not increasing net worth directly and so on.”

Yeah that was stupid of me. Private lending is peripheral to this, but I did find the discussion illustrative… I’m just tin-eared and tone-deaf on what people are fighting about. Sorry.

Agreed. Deficits are a source of private sector savings. But you can clearly have savings without deficits.

Much of this has been discussed here:

http://www.3spoken.co.uk/2012/02/savings-explaining-humpty-dumpty-word.html?m=1

“The government becomes the “money monopolistâ€1 through exercising these

powers. Just like colonial governments, modern States need to obtain goods and services

from the private sector. In order to induce the private sector to sell to the government,

the State imposes a tax obligation on the population in currency, which the private sector

can obtain only from the government. The population, pressed by the necessity to pay its

legal requirements, sells to the government in exchange for currency. Currency may

therefore be viewed as a tax credit to the population that drives the transfer of real goods

and services from the private to the public sector. Of course, over time, secondary

markets will develop so that State money becomes the general means of payment, unit of

account and medium of exchange. In addition, and as it will be discussed below,

governments can turn other money–such as bank money–into State money by

declaring it acceptable for payments at public offices with appropriate restrictions. But

these developments do not change the underlying causal forces at work in determining

the value of the currency”

As has been said earlier, you knowingly prevaricate. This is much, MUCH worse than telling untruths out of ignorance.

” This is much, MUCH worse than telling untruths out of ignorance.”

Clearly Pavlina says the government is a money monopolist. Have I missed something GrkStav?

Quote:

This section briefly discusses some aspects of monetary evolution, in particular

how money became State currency and how the State became the “money monopolist.

At any rate, good that you guys are accepting that the government is not a money monopolist 🙂

What’s more Mosler even endorses Wray’s paper

“Keynes after 75 Years: Rethinking Money as a Public Monopoly”

here.

http://moslereconomics.com/2011/04/06/wray-the-currency-as-a-public-monopoly/

@Bob

This is great, thanks. Neil Wilson’s the greatest.

Now I’d like that for “Private Surplus.” What national-account measures, on what tables, do I add/subtract to get to, say, change in net worth? (From which I can get most anywhere else…)

I guess I’m puzzled why anyone could think that one could come up with either an accounting system for, or general theory of, the production of real wealth – net worth – that focuses entirely on monetary transactions and financial assets alone. Most changes in aggregate net worth are due to changes in public and private stocks of real assets and can’t be analyzed solely by looking at the net financial position of any agent’s balance sheet, or even any sector’s balance sheet.

Yes, certainly private sector lending doesn’t in itself increase private sector net worth. It expands balance sheets, creating offsetting liabilities and assets. But equally clearly, private sector lending is used to finance the production of real wealth from real assets, as Steve notes. Eventually some agent or agents end up with more valuable real assets on their balance sheets after the loans are repaid, and these are assets that are not offset by liabilities. So why is the fact that private credit does not in itself add to real net worth a particularly important thing to notice? This is just a restatement of the obvious: that credit financing is a tool for the production of wealth, not new wealth itself. It doesn’t matter whether the financing involves publicly generated instruments or privately generated instruments. The same is true of publicly provided credit – it only adds to net worth to the extent that it facilitates the production of real, non-financial wealth.

And whether or not that wealth-building process creates an increase in net financial assets is neither here nor there. Even if the net financial position of the private sector doesn’t change, its wealth can increase. And if we had an entirely private financial system in which financial assets, including the monetary ones used as media of exchange, were all issued by and held by private sector entities, and backed by claims on real private assets, then the net financial position of the private sector would always be identically zero. But the private sector could still grow and develop with such a system.

An appreciation of the real economic importance and the vital (and currently neglected and insufficiently exploited) role of government can’t be had just by looking the government’s role as a generator of financial instruments, or even by looking at its role as a regulator of financial systems – although those are important utilities it provides. Viewed organically, as part of the whole economy, the government is just an enterprise – or rather a collection of enterprises. These enterprises happen to be owned by the public as a whole, rather than concentrated private groups of owners. They are generally not run for market profit (for market-obtained revenues that exceed costs), but for the net production of value that is delivered to some or all of the public via non-market means. Because the government’s enterprises include the power, accumulated over years, to apply regulatory organization, moral suasion and even coercive force, where necessary, to move and employ resources on a large scale for large purposes, there are an enormous number of things that governments can do that the private sector can’t do. A government can generate gigantic forms of real wealth that that add value to the inputs employed and consumed in the production of that wealth. Since it is operated by the public as a whole, it can take on and absorb large, strategic long-term risks that are beyond the capacity of even the largest private enterprises. And it can oversee the distribution of real income gains across the whole society to achieve long-term economic purposes in ways market-based distribution is incapable of handling. The reality of these powers and benefits can be made manifest whether or not the government is running financial deficits, and whether or not the private sector has a net financial claim on the government or the government has a net financial claim on the private sector. (Even measuring these financial claims is an iffy proposition, because most of us have a real, but formally unacknowledged net financial obligation to the government for future taxes that have not been assessed yet, but that we know with certainty will be.) If real private and public wealth combined grow by 100% in some given period of time, who cares if the balance of financial obligations has tilted more in one direction or the other?

The internet, and broader economic punditry, has churned up a lot of money-obsessed thinking in the years since the financial implosion. They include things like:

Market Monetarism

MMT

Monetary Realism

New Keynesian Interest-and-Inflation Rate Management

Neo-Monetarism

Bitcoin

Positive Money

(Other Assorted Monetary Cranks and Crackpots)

I think it a symptom of the overly-fictionalized economy that our economic thinking has become overly money-oriented as well. Most of these approaches have been developed by a combination of monetary economists and private sector folks from the money management fields. These are people who have an odd and very limited perspective on the economy, in which the most important real factors are only glimpsed dimly through the haze of the more superficial nominal factors, and in which all kinds of impressive policy results are promised through the tools of nominal manipulations alone. In my opinion, what these schools have in common is more important than the ways in which they differ, and they have all reached a self-limiting and endlessly repetitive dead end because of their inherent inability to discuss fundamental institutional, social, organizational, planning and strategic economic factors in anything but the most superficial ways. It’s like economic discourse now consists entirely of the view from inside the banks and money exchanges, where the whole real economy is only viewed vaguely through the grimy windows, when what is needed is a view from outside in the fresh air of real capital, real services, real capacities, real organizational systems and real productive processes, with only an occasional view taken into the window of the money factories. Take all of those approaches above together: the ratio of the quantity of innovative and transformation policy proposals they have come up with to the quantity of self-referential and incestuous metaphysical theorizing about the true nature of money and whatnot is extremely small.

“the realising of holding gains is always made by a transaction with two parties involved. The net result of these gains and „losses‟ is zero. They cancel out in the sense that realised holding gains always are financed by some counterparty. The counterparty is transferring part of its income/wealth to the party realising the holding gain.

The seller makes a gain and the buyer pays a higher price (implicit loss) than the seller did at the time of acquisition and hereby transfers resources to the seller. The impact on balancing items is the same in absolute value but in different directions (opposite signs) and the net result is zero.”

http://www.iariw.org/papers/2010/4awolf.pdf

An unrealised gain for one person is an unrealised loss for another in any capital transfer.

Only real goods and services can realise the holding gain because they actually do something (you live in your house and consume its services. You don’t live in your share portfolio).

The issue is the different theoretical views of what that means in practice. That paper touches on the debate between the Keynes view and the Neoclassical view.

Dan,

Don’t share your pessimistic view. There are of course more important things to macroeconomics than national accounting but I think it’s an important thing. Most people pontificating on economic matters are simply making an accounting mistake.

But in general I agree with you otherwise – institutional, social and political factors are quite important.

“What national-account measures, on what tables, do I add/subtract to get to, say, change in net worth?”

From the Systems of National Accounts.

Change in Net Worth = net lending/borrowing (B.9) + change in volumes of assets + holding gains of assets

Generally in calculations you find the value ‘Net Worth’ from the balance sheet and subtract it from the previous year’s value to get the change in Net Worth.

So for Households in the UK I’d use sequence CGRC from the ONS (representing S.14 + S.15 in the system of national accounts). That gives me a change in net worth of £215.2 bn for 2013.

If you then subtract the B.9 value from that to get the holding gains. In the UK for households that is sequence NSSZ from the ONS. Which is £-0.092bn for 2013.

So the holding gain is about £215.3bn – mostly the increase in the value of houses.

>Domestic Private Surplus = Government Deficit

I’ve always understood the “private surplus” above to be the “net financial surplus”, emphasis on financial. So it isn’t about private sector net worth because e.g. houses and other physical assets are not included. This is just about private sector assets/liabilities that are held as money, bonds, equity or debt in the national currency, none of which are subject to a net financial gain (unlike houses).

In my reading, MMT is quite careful to differentiate between real and financial assets.

“From the Systems of National Accounts.

Change in Net Worth = net lending/borrowing (B.9) + change in volumes of assets + holding gains of assets”

Not sure what you intend to say, because the system of national accounts does not say that.

Change in Net Worth =

Change in Net worth due to saving and capital transfers

+change in net worth due to OTHER changes in volume of assets

+changes in net worth due to holding gains.

(where gains can be negative as well)

[…] Roth at Asymptosis offers a remarkable, detailed discussion of Modern Monetary Theory’s notion of “private sector surplus” with an emphasis […]

Good post Steve, at least I think so

Yes it opened up a can of worms but its nice to see Ram, Cullen, Neil, Dan, Auburn in the same place. Just like old times before people started closing comments sections (Prag Cap and Mosler) or stopped posting stuff daily (MR). All we need here are JKH, Sankowski, Hickey, Beowulf (where the hell has THAT guy gone!) and maybe even a guest appearance of STF to name just a few ….. the list could be long.

I think the reactions are interesting because in spite of all those old discussions, nothing was REALLY settled. Weaknesses in paradigms were pointed out, confusions arising out of certain ways of thinking were exposed and alternative approaches were put forward but no one had THE definitive answer. Which of course is true of almost everything. The question for each individual becomes what gives YOU the most insight into things you previously found opaque.

The rest of my comment is tangential mostly to Steves post

The thing this post makes me consider is that we have two somewhat competing and somewhat complimentary money systems. Our private system is vast, older, more opaque, has new entries into its “control section” each generation (but some “families” have been in charge for centuries), wildly erratic in short time frames (much less so over decades or centuries) and uses a lot more human judgement when determining value. Our public system is newer (the US one anyway) is available for all to track, changes control/leadership every year in some positions, is less erratic in terms of valuation and is more rule based rather than relying on human judgement. Both have their strengths and its interesting that the private system has more and more wanted input form the public system. In fact it has co opted it.

The discussion of how do we get “richer”, which is at the base of this whole discussion, requires a cooperation between the systems. As Buffet has said all his know how and wealth would be entirely worthless or waaaaaay less valuable if he had to exist under the govt of Somalia or Afghanistan. Govt tax credits ( to use Moslers definition of a dollar, which I like) may be a small percentage of our overall money base (the exact amount can vary by what counts as money) but they play a vastly important role. Take them all away and private sector money is pretty shaky. But the tax credits alone are of no value except to keep IRS gents away form your door.

The description in this piece of how the private sector creates money by altering valuations, which is just claiming they will now loan x dollars against it instead of x+1000 (or x-1000), brings in an important point/question for me. The primary assets which determine peoples worth are their homes and their stock/bond portfolios. Incomes simply go to paying back loans and putting some aside to buy stocks or bonds. When I look at how stocks/bonds are revalued on markets vs houses I see what I think is an important difference, but maybe its not. When a stock has a price of X, that means someone has paid X, in fact many people have paid X, thats how the value moves there. For houses that isn’t so. Im told my house is worth $255,000 but no one has ever paid that much for it. I paid 80,000 for it. Ive put money in for remodelings and added floor space but no one has paid 255,000 for it……..ever. This is true of most houses Im sure. So our real estate market has a value that really no one has ever paid for it before. Its completely contingent/fictional. That is not true of stocks and bonds. The current prices have been paid and any movement is driven by a preponderance of people willing/wanting to pay that new price. These things are changing hands constantly.

I remember a while back Mike Sankowski posting, either at MR or at his previous blog, that monetary policy works through real estate lending . That is its transmission mechanism because it is trying to stimulate private credit creation and land/homes/construction are the prime sources of new credit extension. So our predominate policy (monetary) is trying to stimulate the economy and its transmission mech is via a slow moving/ contingently priced market . Its also trying to do this while many potential market participants are facing a lower ability/desire to service debt in the future. To me its pretty clear why we cant seem to get this plane off the ground and we just keep trying to extend more runway.

Domestic Private Surplus = Government Deficit

This suggests an important truth, as far as it goes: public (monetarily sovereign federal government) deficit spending creates private assets out of thin air.

I don’t see what that trivially true initial statement should be seen as having anything to do with the following statement. The first statement is just a flow-of-funds truism (assuming we are simplifying by leaving the external sector out of the picture.) If you divide any closed economic system into any two sectors whatsoever, then net expenditures in one have to be the negative of the net expenditures in the other. If you divide the whole global economy into Chipotle Grill and Everything That Isn’t Chipotle Grill, then it follows that:

Chipotle Grill Surplus/Deficit = Everything That Isn’t Chipotle Grill Deficit/Surplus

This has nothing to with how assets are created.

Dan,

What you say about Chiptole Grill vs Everything Else is true. But it’s also true that dividing the economy into the government and private sector is a better thing to do.

i.e., that the economy can be divided into two sectors in any which way you want doesn’t mean that dividing it into the government and private sector isn’t illuminating.

This is because of the way the government’s finances works. Total taxes depend on the output and income. The government is in a position to have its expenditure exogenous. Meaning not endogenous to its income, to a good approximation.

Those sort of things cannot be said about the Chiptole example.

“But the NIPAs have a key failing: they don’t include balance sheets.â€

Indeed.

And a man’s ass has a key failing in that it doesn’t include his face.

Look – there are three (not two) essential accounting constructions that are key to an integrated understanding of financial accounts and the underlying transactions and valuations that inform them:

Income statement

Balance sheet

Sources and Uses of Funds (the same thing as flow of funds)

An actual flow of funds financial statement (or sources and uses of funds as sometimes called at the micro level) draws on the information necessary to explain changes in the balance sheet over a given accounting period. These include effects that occur via the income statement, as well as effects that are not captured in income (e.g. the first direct accounting effect of a bank loan that creates a deposit, as per the same point you make in your post. This would show up in a flow of funds statement (microeconomic or macroeconomic), even though in this particular case it is a flow of funds that is internal to a given institutional structure. By contrast, QE is also a flow of funds that cuts across two institution types, yet the accounting entries are not so dissimilar at a high level of generic view on banking operations. These are basically exchanges of assets. And those exchanges will show up in a flow of funds analysis, whether transacted internally or externally in the context of the institutional and sector structure being depicted.) And yes, the balance sheet and the flow of funds both depict valuation changes, WHEN specific valuation changes are incorporated by CHOICE in the closing balance sheet position. For example, the change in the market value of residential mortgages held on balance sheet is typically NOT depicted in either the closing balance sheet or the flow of funds analysis for a commercial bank financial position. There are good reasons for such selectivity, just as there are good reasons for selectivity in choosing to incorporate market valuation changes in other cases, for both real and financial assets. And all of these accounting choices are part of the menu of available options at both microeconomic and macroeconomic financial accounting levels. The choice depends on the purpose of the analysis and the intended audience. But the elementary building blocks of accounting that make those choices available and that make them part of a coherent whole when chosen are firmly grounded in the first principles of accounting statement construction.

The reason that the Fed FOF report is called the FOF report is that the generic FOF perspective is arguably the most comprehensive of the three financial statement types. The Fed report uses the term FOF as a summary title for the three distinct statements in combination. But you will still find each distinct type of financial statement in the full Fed FOF report. And as part of that, the flow of funds financial statement is one of the three types of financial statements, together with the income statement and the balance sheet.

I fully understand the frustration expressed by Cullen in his comment earlier. I’ve become accustomed to disappointment with your posts on this subject, because we spent a great deal of time on this subject in extended discussions on this subject on your blog several years ago, and I have written my own rather voluminous posts on the subject at Monetary Realism, including ones that directly cite some of those extended discussions on your blog.

So, for the record of exchange on this subject, yet again:

It’s a lot simpler than all of the accounting paraphernalia that you offer up in your post.

MMT has tended (tended I say) to discuss their story in the context of a three sector model of the economy. What I have emphasized in the past is that there is also a four sector model of the economy that breaks down the private sector into households and business. It is here that the net financial asset position of the consolidated private sector as per MMT may be seen to be embedded as a subset of the net worth of the household sector itself, “telescoped†into that sector by examining the full chain of claims within the private sector (and I believe “telescoped†is in fact the word that I used in explaining this sort of thing to you in voluminous explanatory comments under your posts from several years ago. Go back and check it out.). The household sector has ultimate claim on the value of that NFA contribution at the consolidated private sector level. I personally find the view from the household sector perspective to be more illuminating for sector balance analysis, so I find the full four sector model more illuminating and richer than the three – for all purposes.

MMT tends (tends I say) to use the consolidated private sector view as a snappier version of the story of sector balances. Good for them. It’s a different starting point. It should also be noted that one can find MMT analyses in which the private sector is indeed decomposed into those two sub-sectors, and the more differentiated four sector model is presented as a result. It’s a matter of which view becomes more natural to their approach to the economics of deficits and whatnot. MMT is not “wrong†in the story they tell, insofar as highlighting the deficit story at the crude three sector level. They are interested in telling the story in the best and most direct way that supports their natural orientation toward a more open minded interpretation of government deficit economics. It’s a simple story, shaped by a choice of sector construction methodology, and shaped by a particular use of language that supports their natural orientation toward deficit friendliness (e.g. the use of the word “net†in some cases, which while risking ambiguity with other uses in macro accounting, makes the chosen point in context.) And consistent with that, Eric Tymoigne’s comment earlier is reasonable to me as a form of reconciliation by way of connecting the different perspectives. As he says, it’s a matter of focus. That doesn’t mean he or they are ignorant of further slices in the accounting construction. It’s a choice. But as I have written in the past, it is not a choice I would make myself as a primary explanatory framework.

(I wonder how well it flies in the political process. I understand Stephanie Kelton is on the Bernie Sanders team, and I would guess she has spent time explaining the private sector net saving perspective as a potential tranquilizer for popular deficit phobia. Knowing that, poor Bernie may feel like he’s walking around with a hand grenade in his pocket, wondering if he should pull the pin and throw it.)

I’ve been pretty harsh on MMT in several posts I’ve written in the past for some pointed reasons. But I’d be careful about attacking them the way you have, alleging or implying some ignorance in the area of balance sheet observance. That’s simply not the case. For example, I believe Minsky was Wray’s PHD supervisor.

And Scott Fullwiler knows central bank balance sheets better than most anybody around. I think I feel his pain when he sees how somebody like Paul Krugman can attempt to write about central banking or banking more generally and completely muck it up. The next time Krugman writes incoherently about this stuff (which will be the next time he writes about this stuff) I’d love to see a carpet bombing of comments, all of which might well read:

“Dr. Krugman. Have you ever taken a course in financial accounting?â€

The answer must surely be no. Because there’s no way somebody as smart otherwise as Krugman could possibly write about monetary operations the way he does, and at the same time actually be knowledgeable about the accounting that is the necessary underpinning for understanding the transactions in question in a coherent way. He would write in a very different style if he did. And so it is with most of the economics profession, which is a general point to be made.

That’s a nice accounting statement you have in the post. But such information on valuation effects is quite available in the complete set of tables in the Fed flow of funds report. The valuation effect can be backed out at the broad level from change in net worth by subtracting income between two balance sheet dates, and I’m quite sure the same level information can be found in the full set of reports in a more direct way. But what is important is that it all hangs together in a conceptual way, as per the accounting first principles I highlighted at the beginning of this comment, and that there is enough information sliced and diced in the full report to go looking for the detail that one is interested in. I don’t dispute the fact that some may prefer SNA or IMA for additional convenience, but there is zero substance for example to the contention that the Fed report is inadequate in a conceptual way and as a starting point for the hunting down of detailed data in any dimension that matters, including valuation.

My generic point is that the deep challenges involved in thinking about this area of economics will never be resolved by endlessly offering up ever more iterations of ever more torturous slices of data in report or revised accounting construction. This rather is the approach of a bottom up bean-counter, struggling to re-invent the world of bean counting in the delusional belief that such an exercise changes the meaning of what is already known in the construction of the accounts. SNA and IMA are fine, but so is the Fed flow of funds report. Those who know how to think about financial accounting from first principles (which is about top down logic, not bottom up bean counting), where I started this comment, can make the required connections quite quickly and then go hunt down desired detail in an infinite array of desired slice and dice presentations. And that could involve hunting down across a comparison of these available macro frameworks, as well as accessing more micro slices of information at a lower level of detail. But that’s just an information research project.

As for your quick analysis of banking, it is misleading and logically inconsistent in its accounting comparison. On the one hand you talk about simple static asset-liability balance sheet accounting in banking. On the other hand, you talk about the knock-on activity associated with bank lending in the development of income by those who borrow. That’s apples and oranges, and incongruous in the comparison. In fact, a balanced comparison would observe that bank profits arising from those balance sheet lending positions are a component of macroeconomic income, and bank retained earnings being a subset of those profits are a direct gross contribution to macroeconomic saving.

“Stop it you guysâ€.

I’d change that to:

“Stop it Asymptosisâ€

You seem to think that you making strong headway in leading some sort of accounting revolution here, when what you are doing in effect is only moving around different pieces of a puzzle that is already resolved from first principles financial accounting, including valuation effects. You can’t start in the middle of that puzzle, throw the pieces of the puzzle up in the air, try to reinvent first principles in the process, throw out standard definitions used in elementary construction, and come to anything other than redundancy and/or incoherence at the end. You will end up painting yourself into a corner of existential puffery on the subject, an effect you seem to achieve repeatedly when seen from a slight distance that offers the perspective on it.

In the comments, from you:

“Even G-L (all praise) don’t even mention Haig-Simons until page 140, and they don’t start incorporating it until page 290. I think it should right up front, incorporated as “income†from the word go, as in the accounting structure here.â€

Well, that’s what you think. But the reason it is done that way is because, fully understanding the logic of accounting construction, Godley and Lavoie assemble the required constituent pieces gradually and methodically (and in elegant fashion), according to the logical order of that construction, throughout the development of the book. They build the house from the ground up, not from the upstairs bathroom out. That’s the whole point of why the book is organized the way it is. The first logical piece is the original generation of income. That’s before valuation effects overlay the original generation of product value and equivalent income, over time. You don’t get coherent integration without consistent differentiation as the foundational analysis. You don’t build analysis from the starting point of a steaming vat of income and valuation already pre-mixed. You start with understanding the ingredients. And the ingredients are known in accordance with the principles of logical accounting construction. The entire GL book is constructed in this way, beginning to end, and it is extraordinarily well done indeed.

Don’t tear down a fence until you know why it was put up in the first place. The pieces of the puzzle are already available.

(And I’ll remind you again – I am not an accountant. It’s about mathematics and logic (mostly Boolean) as much as it’s about accounting.)

P.S.

Nice comment from Greg, with a thoughtful perspective on the history of all this.

The good old days…

🙂

Greg,

Not sure what your point about houses is. I have seen a lot by commenters in MMT blogs on this (although not by MMT economists). There’s some undertone to this that houses shouldn’t be counted and so on.

But consider this hypothetical case: We are neighbours with similar looking house and quality. Your house is ten times the area of my house. My house is say valued at $100,000. I have some $100,000 more than you in deposits/bonds/stocks. But aren’t you richer?

@Ramanan

Are you saying that my statement of accounts doesn’t balance out? Cause it does. It’s based entirely on IMA S.3.a, and the arithmetic adds up perfectly. I can send you the spreadsheet.

It’s just a different way of selecting, presenting, and labeling the accounting — one that I find far more transparent than most. I find it to be usefully explanatory and intuitive in its presentation of how economies work — notably in it clear and concise representation of the flows affecting HH net worth.

There’s much that it doesn’t impart, of course, that other representations do. But the reverse is also true.

@Asymptosis

That response was to Neil Wilson.

First he uses surplus instead of saving.

Second he adds a volume measure instead of a dollar-measure.

Not a brilliant article above. E.g. the article attacks the “public deficit equals private surplus†idea as being a tautology. Well that tautology is better than what preceded the tautology, namely complete ignorance of the fact that a public deficit increases private sector net paper assets. Indeed, many so called professional economists still don’t seem to understand that truism.

Second, the article claims “But contrary to what’s at least implied by the equal sign, deficit spending is not the only way that private assets increase…. Not even close.†So who ever made the patently absurd claim that public sector deficits are in fact the only way private sector assets increase? No one that I know of.

@Ramanan

My only point about houses and real estate in general is that when you look at the overall value of the market, as compared to say stocks and bonds, there is a lot more subjectivity to the prices. As I said, every stock price has already been realized. Thats how the stock gets to a price X because enough people paid X for it. Many, if not most, houses and land have a price which has never been paid for it, so its just a different type of market. In the money creation process within the banking system, stocks, bonds and real estate are huge components of the process by which money gets created (or lost). Additionally our modern policy prescriptions seem to do their magic through these real estate channels.

Im not saying houses/real estate shouldn’t be counted but we do need to realize their limitations in the financial system and not run primary policy through them

Consider the case of the average American today. Not much in saving, income being cut or not keeping up with cost of living as well as years ago but they have a house to live in. Todays policy makers are essentially trying to support their real estate prices so they can take out another loan against it, putting them further in debt and with a dubious promise that their rise in real estate values will offset that. What they need is liquidateable equity OR more income. Fiscal policy can give them that by, as MMT says, increasing their NFAs and improving their net saving by having more dollars in their checking at the end of the month. The increase in NFAs does make them better off.

@Greg

Agree generally. My point was that illiquidity and difficulties in getting data are important things but it’s better to be approximately right than having no information.

About the point on NFA … and SRW also had a post on it … the primary aim is not NFA. Which is to not say that NFA is not important .. it is important of course. But the way fiscal policy works is not via NFA but by boosting domestic demand and hence output. This results in people having higher incomes and they accumulate assets.

The reason this is important is because one can have the private sector behave in a way in which private expenditure is higher than private income (for whatever reasons … great expectations of the future and so on). And if the government simply expands fiscal policy, it is not given that NFA will rise. It might fall as well (because of higher expectations of the future). But output will rise, income and expenditure both rise with NFA falling.

So fiscal expansion shouldn’t be used synonymous with rising NFA.

@JKH

Such good stuff. Thanks. Either I’m getting better, or you are (I think both), cause I understood almost every word of this. Many Yes!es for me, and a couple of Aha!s.

>there are three (not two) essential accounting constructions

Point very well taken. Thank you.

>These are basically exchanges of assets. And those exchanges will show up in a flow of funds analysis, whether transacted internally or externally in the context of the institutional and sector structure being depicted.)

Interestingly (this is basically an aside; something I’ve pondered): I don’t think that Revaluation Account changes in asset values are directly linked to Flow of Fund asset-exchange transactions accounting. They’re not “microfounded.” Rather they’re estimates independent of those flows, employing various indices of asset market values.

>And yes, the balance sheet and the flow of funds both depict valuation changes, WHEN specific valuation changes are incorporated by CHOICE in the closing balance sheet position.

Exactly. Which highlights that I’m making a “should” statement here about accounting choices. The national accounts should incorporate revaluation/cap gains in a (note: a) top-level measure of “income” (hence saving). The accounting presentation in this post highlights that measure (Comprehensive Income), making the change-in-net-worth mechanism clear and intuitive. But it also provides Primary Income (only slightly altered from Balance of Primary Incomes, in its accounting for interest paid), and a measure of Comprehensive Disposable Income (Comprehensive Saving + Consumption Spending) — IMO an extremely useful and intuitively comprehensible explanatory measure.

(When I’m done answering comments, I’ll put together my next post: “Capital Gains *Are* Income.” It’s a choice!)

>And all of these accounting choices are part of the menu of available options at both microeconomic and macroeconomic financial accounting levels.

Right. I’m expanding the menu of options, and suggesting that the “nudged” menu options should be different.

>The choice depends on the purpose of the analysis and the intended audience.

I could certainly be wrong, but I think many others would also derive much understanding, fairly easily, from this presentation. Not sufficient, of course, but strongly contributory.

>It’s a lot simpler than all of the accounting paraphernalia that you offer up in your post.

The sectoral accounting you suggest as an alternative is also accounting paraphernalia, and I at least don’t think it’s simple, while I think my presentation of accounts is. (We have here a whole slew of people yelling at each other over how obvious and simple this all is…) I get it (mostly…), but it’s not sufficient for me to grok this stuff. Especially its relationship to (changes in) household/private net worth, and the nature of NFAs as a stock. Looking for help with that:

http://www.interfluidity.com/v2/6174.html#comment-41885

>I personally find the view from the household sector perspective to be more illuminating for sector balance analysis, so I find the full four sector model more illuminating and richer than the three – for all purposes.

Back to intended audience and purpose. I tend to agree with you on this choice, but others (especially those who are lacking your [or even my] chops) may find greater illumination, intuitive understanding, of particular large and small aspects via other choices and presentations.

I’m very curious about how net worth (HH = private-sector) spans the gap between the three- and four-sector models. That may encapsulate what I’m trying to understand, and explain confusions that I display. I don’t see how that relationship can be presented clearly, simply, and comprehensibly if revaluation/cap gains are not part of income. (Of course what JKH finds clear, simple, and comprehensible is different from most…)

>poor Bernie may feel like he’s walking around with a hand grenade in his pocket, wondering if he should pull the pin and throw it.)

This whole para is so good. I’ve said many times that accounting statements are rhetorical (and political) statements, attempts to describe the world in particular ways that inevitably, persuasively, suggest which future actions are “reasonable.” (The rhetorical virtue and suasion of an accounting statement, of course, rests first on its underlying accounting consistency — or at least it should.)

>I’d be careful about attacking them the way you have,

Goshdarnit I wasn’t attacking them! (Or at least no intention.) The first paragraph is a paean to them. Go read it. I call Stephanie “redoubtable,” (a word I’ve also used for JKH…), and Wray and Tymoigne “extraordinaire.” Later: “I wouldn’t be thinking these thoughts if it weren’t for the MMT cabal.”

I was just stupid, not realizing how stupidly vituperative these discussions have become, where any questioning of accounting terminology is seen as an attack.

And: all those old arguments and resentments have prevented everyone from addressing the gist of the post, on cap gains and income/saving.

>That’s a nice accounting statement you have in the post.

Thank you. It would be great if somebody in this thread would make substantive comments on its (and its labeled measures’) usefulness, explanatory value, comprehensibility, rhetorical import, etc. etc. Does it serve any particular audience(s) seeking any particular insights? Does it present important accounting realities that are otherwise obscured or difficult to find (for many or most)? I think yes.

>such information on valuation effects is quite available in the complete set of tables in the Fed flow of funds report. The valuation effect can be backed out at the broad level

That’s exactly what the accounting statement does. “Oh yeah, sure, I could back this all out” is not the same as “Hey check this out, I’ve done it for you.”

>there is zero substance for example to the contention that the Fed report is inadequate in a conceptual way

What percent of people, or of economists!, could explain the relationship between income, saving, and change in net worth, off the top of their head? I would suggest it approaches 0%. (Yes, I know you will agree this is a failure of economics training, but…) You are of course correct: the accounts as presented don’t have a conceptual problem; they’re perfectly coherent. But they certainly create one, and it might not be a necessary one.

>the deep challenges involved in thinking about this area of economics will never be resolved by endlessly offering up ever more iterations of ever more torturous slices of data in report or revised accounting construction.

I disagree. There are ways to present and explain the national accounts and the national economy in ways that many can understand more correctly and more easily — that don’t require CFA-level skills. That, in fact, is the very challenge that Stephanie and Bernie face, as you pointed out so well.

>a balanced comparison would observe that bank profits arising from those balance sheet lending positions

Right I ignored interest on loans — the future accounting events that inevitably result from lending/borrowing. I also only mentioned the purchases that are caused/enabled by lending. I was only addressing the accounting events that occur at the moment of lending — nothing ensuing. I believe my accounting is correct for that lending event?

>Godley and Lavoie assemble the required constituent pieces gradually and methodically

I am not competent to say: could they (or others) assemble an equally coherent ground-up accounting/economic explanation if they started with Haig-Simons accounting, incorporating cap gains into income and saving from the beginning?

Thanks,

Steve

@Greg

Thanks, a very nice and clearly-worded comment.

On the equity vs real-estate valuation. I see the key differences as frequency and accuracy. Stocks get marked to market constantly. Houses only occasionally (because they sell so much less frequently). But people do somewhat regularly mark their home values to market in their heads, and also on paper — especially when you get with a few decades of retirement. You start tallying up your net worth and considering how long you have to work based on that; estimating your home value is a key part of that.

On the national-accounts level, though, the Fed does this for us based on various market indices.

SR,

Btw … you might find Sec 3 here interesting.

http://www.levyinstitute.org/pubs/implos.pdf

Steve,

Thanks for responding. That helps the discussion for me.

I was beginning to want the last 8 hours of my life back.

I feel confident I can defer that urge for at least another 2 hours now.

🙂

But hopefully altogether.

I’ll just do a few quick ones now regarding certain points in your comment.

Steve,

Here is the very first paragraph of the latest Z1 report:

“The net worth of households and nonprofits rose to $85.7 trillion during the second quarter of 2015. The value of directly and indirectly held corporate equities increased $61 billion and the value of real estate rose $499 billion.”

What I’m saying is that a flow of funds statement is an explanatory report that connects the balance sheet at the beginning of an accounting period to the balance sheet at the end.

Those change numbers are changes in the balance sheet position for equities and real estate respectively.

So a flow of funds statement will include exactly those numbers at the highest level of the numbers that appear in the statement.

From there, as is the case for all such numbers that depict the flow of funds, its a matter of drilling down into those numbers to see how that happened. The availability of that detail will depend on the granularity of the explanation that accompanies the statement, plus the initiative of the reader to go and get more down-level detail from all manner of sources. But that is the basic logic. The revaluation effects are in there, because the authors of the flow of funds report suite in total have chosen to include equity and real estate revaluation in their balance sheet report.

And here is the most aggregate level for that drill down:

If you take the delta number for the $ 85.7 trillion during the quarter (i.e. the change from the previous quarter), you can decompose it into 2 parts – a chosen measure for income, which comes from an entirely separate type of financial statement (e.g. GDP/GDI) and the residual, where the residual becomes by default your revaluation number).

And what you get is:

Change in net worth = income + revaluation

Now that is the crude logic of it, and why I say the numbers are already there in current reporting to do that

And you get something simple like the table in your post

No problem with that

But that’s a choice for a particular report format coming out of the data

It doesn’t mean you throw out the basic definition of GDP/GDI

AUGMENT the standard definitions with a menu of reporting options

don’t REJECT (e.g. GDP/GDI) or REPLACE the starting points for the entire construction

the menu is an augmentation from the alternative of being restricted to a core meal

e.g. Haig Simons is an option – an adjustment to the basic definition of income – not a displacement of it

if you lose the basic definition, you lose the the decomposition of Haig Simons!

you will have demolished your house by setting off a bomb in the second floor bathroom, because you like it so much in there and that’s where you wanna die

“(When I’m done answering comments, I’ll put together my next post: “Capital Gains *Are* Income.†It’s a choice!)”

NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO! NO!

That’s NOT what I mean by choice.

What I mean is this, for example:

The core income measure comes from standard income accounting. I think that means GDI, which is the income generated by GDP. The important point is that the core measure does NOT include the kind of revaluation that will show up in a balance sheet or in a flow of funds report showing balance sheet changes over the accounting period. That is NOT a choice.

The choice is whether or not you want to augment that with a SUPPLEMENTARY measure such as Haig Simons or what you have in your table.