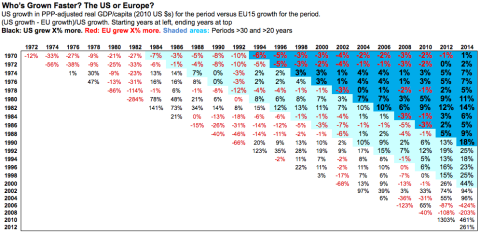

I’ve pointed out multiple times that despite Europe’s big, supposedly growth-strangling governments, Europe and the U.S. have grown at the same rate over the last 45 years. Here’s the latest data from the OECD, through 2014 (click for larger):

And here’s the spreadsheet. Have your way with it. More discussion and explanation in a previous post.

You can cherry-pick brief periods along the bottom diagonal to support any argument you like. But between 1970 and 2014, U.S. real GDP per capita grew 117%. The EU15 grew 115%. (Rounding explains the 1% difference shown above.) Statistically, we call that “the same.”

Which brought me back to a question that’s been nagging me for years: why hasn’t Europe caught up? Basic growth theory tells us it should (convergence, Solow, all that). And it did, very impressively, in the thirty years after World War II (interestingly, this during a period when the world lay in tatters, and the U.S. utterly dominated global manufacturing, trade, and commerce).

But then in the mid 70s Europe stopped catching up. U.S. GDP per capita today (2014) is $50,620. For Europe it’s $38,870 — only 77% of the U.S. figure, roughly what it’s been since the 70s. What’s with that?

Small-government advocates will suggest that the big European governments built after World War II are the culprit; they finally started to bite in the 70s. But then, again: why has Europe grown just as fast as the U.S. since the 70s? It’s a conundrum.

I’m thinking the small-government types might be right: it’s about government. But they’ve got the wrong explanation.

Think about how GDP is measured. Private-sector output is estimated by spending on final goods and services in the market. But that doesn’t work for government goods, because they aren’t sold in the market. So they’re estimated based on the cost of producing and delivering them.

Small-government advocates frequently make this point about the measurement of government production. But they then jump immediately to a foregone conclusion: that the value of government goods are services are being overestimated by this method. (You can see Tyler Cowen doing it here.)

That makes no sense to me. What would private output look like if it was measured at the cost of production? Way lower. Is government really so inefficient that its production costs are higher than its output? It’s hard to say, but that seems wildly improbable, strikes me as a pure leap of faith, completely contrary to reasonable Bayesian priors about input versus output in production.

Imagine, rather, that the cost-of-production estimation method is underestimating the value of government goods — just as it would (wildly) underestimate private goods if they were measured that way. Now do the math: EU built out governments encompassing about 40% of GDP. The U.S. is about 25%. Think: America’s insanely expensive health care and higher education, much or most of it measured at market prices for GDP purposes, not cost of production as in Europe. Add in our extraordinary spending on financial services — spending which is far lower in Europe, with its more-comprehensive government pension and retirement programs. Feel free to add to the list.

All those European government services are measured at cost of production, while equivalent U.S. services are measured at (much higher) market cost. Is it any wonder that U.S. GDP looks higher?

I’d be delighted to hear from readers about any measures or studies that have managed to quantify this difficult conundrum. What’s the value or “utility” of government services, designated in dollars (or whatever)?

Update: I can’t believe I failed to mention what’s probably the primary cause of the US/EU differential: Europeans work less. A lot less. Like four or six weeks a year less. They’ve chosen free time with their families, time to do things they love with people they love, over square footage and cubic inches.

Got family values?

I can’t believe I forgot to mention it, because I’ve written about it at least half a dozen times.

If Europeans worked as many hours as Americans, their GDP figures would still be roughly 14% below the U.S. But mis-measurement of government output, plus several other GDP-measurement discrepancies across countries, could easily explain that.

Cross-posted at Angry Bear.

Comments

7 responses to “Wait: Maybe Europeans are as Rich as Americans”

[…] Just out from this author, check out the latest figures on growth and prosperity in big-government Europe versus small-government […]

Steve supplied an answer to a question I left over at Noahpion yesterday. Noah also made the point that US and European growth tracked together.

“All those European government services are measured at cost of production, while equivalent U.S. services are measured at (much higher) market cost. Is it any wonder that U.S. GDP looks higher? â€

This answer is very important to me because I am trying to make the case that the economy is sort of a perpetual motion machine and that inputs always become outputs and vice-versa. In my case it is to do away with the worry that higher consumer prices caused by collectively bargaining labor will cost jobs.

* * * * *

To wit [cut-and-paste]:

In a high union density (or a high co-op, that is employee owned) market consumers will pay more for less goods from firm “A†— causing some of firm “Aâ€employees to lose jobs; and because consumers who continued to patronize firm “A†in spite of higher prices now have less money to spend over at firm “Bâ€, some employees will be laid of fat firm “B†also. If the employees of “A†now hide their new pay raises under their mattresses that will be the end of the economic effects.

But I’m guessing that the employees of firm “A†will have a propensity to spend their new incomes at firms “Xâ€, “Y†and “Z†and don’t forget “B†and don’t forget even “A†— making jobs for the formerly laid off employees of “A†and “B.â€

This perpetual motion machine ran on auto-pilot during the “Great Compression†(as long as you were white) — even under a five-star general, Republican president who didn’t know that much about this country having spent most of his life outside of it and note to quick to worry about segregation. The perpetual motion mechanism: high union density.

Of course if too much (way too much!) income leaks off to the top 1% who can’t spend it fast as they get it the motion slows down. I think this is called secular stagnation.

And if too little income reaches the bottom the productivity of a huge (and growing) segment of the workforce (or would-have-been) workforce drops way off due to lower education and even lower nutrition and more generally dysfunctional society (e.g., 100,000 Chicago gang members).

* * * * *

But if greater American inequality is supposed by unfettered market folks to make us more efficient I was left to come up with an counter explanation why are the more equal European economies apparently lower than us (same growth remember) in per capita output. All important question to me — now answered.

I could add that of course Europeans work shorter hours than Americans. I think that a few years or more back we worked 50% more hours than Germans though that gap may have closed up some now.

This is a good point. I suspect, though, that it is just the tip of the iceberg. I do not know how European countries count GDP — how they treat owner-occupied housing, imputed interest, nonprofits, etc. — or how they calculate the CPI — hedonic adjustment for quality changes, the way the weights in the basket are chosen — but I would be very, very surprised if it is identical to how it is done in the US. I expect that if you used a standard methodology the relative growth rates might look quite different — tho I have no idea which way the difference would go.

Anyway I think you’re asking the right question. People are way too uncritical with these numbers.

Robert Gordon has one of the few papers I’ve seen that tries to address some of these issues: economics.weinberg.northwestern.edu/robert-gordon/BRU_071125.pdf

You might also be interested in this: http://www.newyorkfed.org/research/current_issues/ci15-7.pdf

I believe a couple of years back I saw an older story (from around 2000, in the WSJ if memory serves), to the effect that Germany at least applied a more conservative way of measuring GDP growth than the US government did. I do not know whether that is still the case (or whether that was even accurate at the time), but I mention it to suggest that how different governments calculate GDP might be well-worth investigating further.

@JW: “tip of the iceberg”

Right. I read somewhere that I can’t find that many European countries, for instance, do no hedonics. (Which seems both admirable and insane to me…) Just one item, but…

The main thing driving the difference, I’d say, is not measurement, but manpower. I can’t believe I left that out here. I’ve written about it enough… Europeans work less. Like four or six weeks less per year.

Which of course leads me to ask: does all that leisure time, time with family and doing things they love, have “value”? If it does, shouldn’t in be counted in GDP as produced value?

If productivity goes up, there’s more leisure time. Wasn’t that leisure time “produced,” at least relative to the counterfactual of lower productivity?

Thanks for the links. I’ll spend some time with them.