I’m rather devastated to find (thanks to Tom Brown at Pragmatic Capitalism!) a discussion I missed at Winterspeak’s place from mid-December, with some of my favorite commenters going after the underconsumption argument that I’ve been going on about.

It starts by citing Mark Sadowski’s comment from Interfluidity “clarifying the difference between wealth and income.”

I found that rather puzzling at first because the first-blush, obvious difference between the two is that one’s a flow and one’s a stock. Duh. But I figured out that he’s actually distinguishing between income and capital gains, making the well-known point that in the language of national accounts, capital gains aren’t income.

I’d like to address two points here:

1. I think JKH would say that this is all as it must be — that it’s conceptually incoherent to think of capital gains as income. I understand why he would say that. But I’d like to push back on that.

Imagine a company in two counterfactuals — a simplified, stylized representation.

Scenario A: All earnings/profits are paid to shareholders as dividends every year. Book value remains unchanged.

Scenario B: All earnings are retained. Book value increases 1:1 with earnings.

Now: a shareholder holds shares for thirty years, then sells at book value. (Assuming the paid-out dividends and the retained earnings are “invested” identically — say in physical cash that earns no interest, to keep things simple.)

At the end of the period, the shareholder has received all those earnings in each scenario, and has identical wealth in each scenario.

Is it conceptually coherent to say that in scenario B, the shareholder had zero income?

Within the linguistic and logical constructs of the national accounts, yes. But in any reasonable economic construct, it’s crazy. The shareholder accrued those earnings every year; they were just “unrealized” via sale. Just because those earnings were tallied up on the corporation’s books, instead of the individual’s (and eventually transferred to the individual’s), can we reasonably say that the shareholder’s share of corporate earnings were not accrued income?

See JW Mason’s comments at Winterspeak for more on this, expressed more authoritatively than I can achieve.

2. Sadowski says “In underconsumption theory recessions and stagnation arise due to inadequate consumer demand relative to the production of new goods and services.”

That may be true. But I would suggest that underconsumption theory is not nearly so standardized — that in fact it’s wildly un(der)theorized. (I do wish [liberal] economists would get on this hobby horse…)

In my bruited notion of underconsumption, stagnation arise[s] due to inadequate consumer demand (“spending”) relative to wealth — which I define somewhat roughly as the total stock of financial assets. (Claims on real assets, or future production, which have a rough equivalence that I won’t discuss further here.*)

It’s a straightforward monetarist(ic) velocity argument, but with “money” defined as “the exchange value embodied in financial assets.” (In this construct, all financial assets embody money, including those things like currency that have traditionally, in the vernacular, been called “money.”) So the “money stock” is the market value of all financial assets, from dollars to deeds (yes, deeds) to CDOs.

Because of declining marginal propensity to spend relative to wealth (which I think no one will contest), increased concentrations of wealth, arithmetically and inexorably, result in lower money velocity, ceteris paribus.

I posted two graphics to demonstrate this velocity/stagnation situation over the decades. (You can argue with the specific economic measures used here, but they’re reasonably representative of the big picture.)

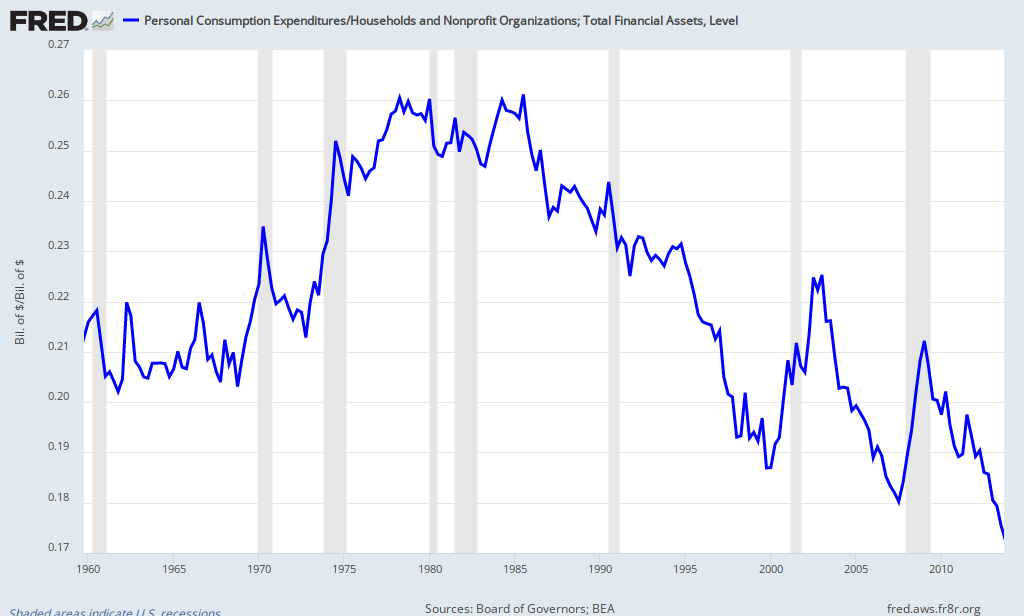

Personal Consumption Expenditures as a percent of Household Financial Assets:

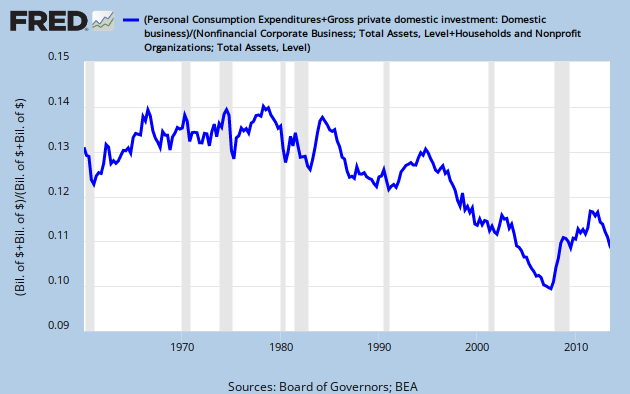

(Personal Consumption Expenditures + Business Investment Spending) / (Household Total Assets + Business Total Assets)

Now these are showing ratios, and it’s possible that an increased denominator (assets) is where the big secular change occurred: arguably many more of the country’s real assets were financialized/monetized/capitalized over the decades shown. (Think: student loans monetizing/present-value-capitalizing those student’s human capital and future earnings.)

But if we’re just surmising, we can say it’s equally possible that the declines here are numerator-driven — resulting from declining spending out of wealth due to wildly increased wealth and income concentrations. I’d expect that both are true.

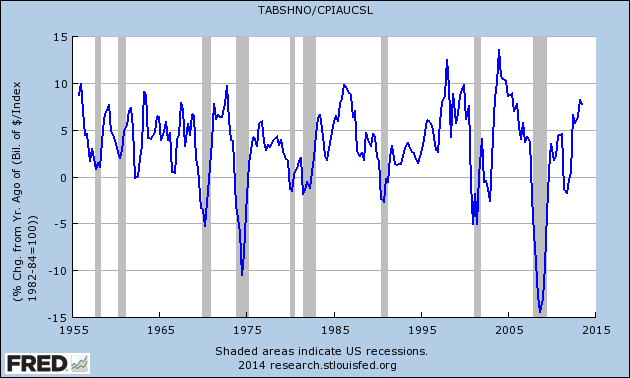

Somewhat as an aside, I also made a straightforward “money-supply” assertion about recessions, again using my preferred definition of “money.” I’ll share it in the concise language that Twitter requires and encourages so admirably:

Every recession since ’60 preceded by decline in infl adj value of HH assets. Two false (?) positives: 02 and 11.

— Steve Roth (@asymptosis) January 10, 2014

This is getting long so I’ll stop here, with one final assertion:

Any aggregate consumption function (viz: Keynes’) that doesn’t incorporate some measure(s) of wealth, that doesn’t incorporate some measure(s) of wealth and income distribution, and that doesn’t include (distinct and probably interdependent) functions for declining marginal propensity to spend out of wealth and out of income, is useless.

* I have to toss in one more pet peeve here: financial assets (often called financial “capital”) are not capital! They’re claims on capital. And contrary to much sloppy and often implicit thinking and discussion that you see out there from professionals and amateurs alike, they’re not an “input to production.”

Cross-posted at Angry Bear.

Comments

10 responses to “Underconsumption, Income, Wealth, and Capital Gains”

Nice post SR.

Especially liked your paying out dividends versus retaining part.

I am beginning to think that international wage deflation has been more deflationary for the world as a whole via the Webb effect (or the opposite of it) as compared to fiscal policy.

“stagnation arise[s] due to inadequate consumer demand (“spendingâ€) relative to wealth — which I define somewhat roughly as the total stock of financial assets.”

Agreed. Where you use the word “wealth” or the phrase “the total stock of financial assets” I generally just say “savings” — but I think we’re saying the same thing.

It looks to me like the goal of saving is not to spend. The holder of financial assets wants to hold them. They generally don’t circulate. They are not funds that are readily accessible for spending.

Economic activity, and growth, depend on spending, on the funds available and the circulation of those funds.

The funds available for circulation are those which make up income. The sedentary funds — financial “wealth” or “savings” — cannot become income unless they move out of savings and into circulation.

As the ratio of circulating funds to sedentary funds falls, economic activity becomes more difficult — and more expensive, if borrowed funds are used.

Where I use circulating funds in that ratio, you use the income generated from those funds. Or rather, the part of that income which is recirculated. Closely related.

Also, as the ratio of circulating to sedentary funds falls, the economy becomes more unstable and less subject to the constraints of monetary policy. Holders of sedentary funds have the same role as the central bank: to decide when they will put more funds into circulation.

@Ramanan:

Thanks! Webb effect? Sure, yeah, but I’d need to see Kahnemann/Tversky-quality, Prospect-Theory type evidence to be convinced it’s a big effect. I find the much more mundanely arithmetic velocity effects more convincing. Saving comes from surplus. Surplus derives from production. Production is spurred by spending. I’m really not being facetious when I say that spending, not saving, causes saving.

Arthur: per the above and many previous, I really, really try to avoid the word saving. Nobody uses it in the same way or really understands it. Killer great paper I just came across:

Saving does not finance Investment

http://www.boeckler.de/pdf/p_imk_wp_100_2012.pdf

“the ratio of circulating funds to sedentary funds falls”

I get confused by “circulating funds.” They’re only “circulating” — in transfer — for a nanosecond (conceptually, an infinitely small instant). Then they’re sitting in some other account.

There’s a stock of financial assets (money), and it turns over at some rate. (Only counting those transfers that are for purchases of real goods/services, so they spur production; other transfers — even for house buying — are just financial-asset swaps.)

Transactions are instantaneous flows. The stock of funds commonly used for transaction purposes is said to be circulating. The stock of funds commonly not used for transaction purposes is sedentary. That’s how I see it.

@The Arthurian

You own some Apple stock and want to buy a car.

You sell the stock (exchange it for bank deposits), then exchange the bank deposits for the car.

Was the Apple stock (and the money embodied therein) “circulating”?

This JP Koning post is a propos:

http://jpkoning.blogspot.com/2013/05/long-chains-of-monetary-barter.html

I totally get where you’re coming from on this, just don’t think “circulating money” is a conceptually tractable way to think/write about it.

Is this the paper Mark Sadowski refers to?

https://www.dartmouth.edu/~jskinner/documents/DynanKEDotheRich.pdf

@Ramanan

Ramanan, is this correct?

S = I

S = Y – C and I = everything else and everything else = Igoods + financial assets that are not MOA/MOE (FA) + MOA/MOE

Y – C = Igoods + FA + MOA/MOE

@Fed Up

In the NIPAs, financial-asset swaps are ignored; they’re not part of Saving or Investment.

In the Fed Flow of Funds Accounts, they are tallied, but are not part of I or S.

In the Integrated Macroeconomic Accounts (IMAs), based on the international System of National Accounts (SNA), financial asset swaps are tallied in the Financial Account under Net Acquisition of Financial Assets and Net Incurrence of Liabilities.

The NIPA usage of “Saving” (i.e. gross saving) is completely absent from these accounts (hallelujah!); there is only Net Saving (i.e. I think, financial or money saving — not including “saving” by creating drill presses), in the Current and Capital Accounts.

Likewise, “Investment” is absent from these accounts. It’s tallied in the Capital account under “Capital Formation.”

IOW the IMAs make a clear and conceptually coherent distinction between purely financial and real.

Good explanations of how these accounts differ:

http://www.bea.gov/scb/pdf/2007/02%20February/0207_macro_accts.pdf

You can take a look at the IMAs, and see more papers about them, here:

http://www.bea.gov/national/nipaweb/Ni_FedBeaSna/Index.asp

@Asymptosis

So my example works for IMA based on SNA?

@Fed Up

Can’t answer your question, actually, because S and I as commonly used don’t exist in the IMAs. There’s nowhere, for instance, that they add together capital creation + NAFA, which is pretty much what “Saving” (“gross saving”) means in other schemas.

Spend some time looking at their one-page tables for each sector. Illuminating. I’m doing likewise…