I heard him on an NPR show last night, and was pulling my hair out with frustration.

I admit that was partly because of comments by Cato’s Chris Edwards, who acts as if Keynesians don’t believe in monetary policy, calling them “childish.” When in fact it’s fundamentalist monetarists (read: supply-siders) who refuse to believe in fiscal policy. At all.

But Tyler: He’s still on with his claims that government deficit spending during WWII (to the tune of 70% of GDP) had nothing to do with ending the Great Depression. His main argument is that life didn’t get any better during the war–people weren’t buying anything. So obviously, all that deficit spending had no effect at all.

People during WWII weren’t spending for obvious reasons, of course — mainly that there was nothing to buy. Everything was rationed, even clothing; huge swaths of industry stopped making consumer products for domestic consumption; 50% of output was going to the military, largely overseas. (And talk about Higgsian regime uncertainty! People didn’t know who was going to win the bloody war.)

Today, spending 70% of GDP would mean $10 trillion in stimulus. Obviously that would have no effect either.

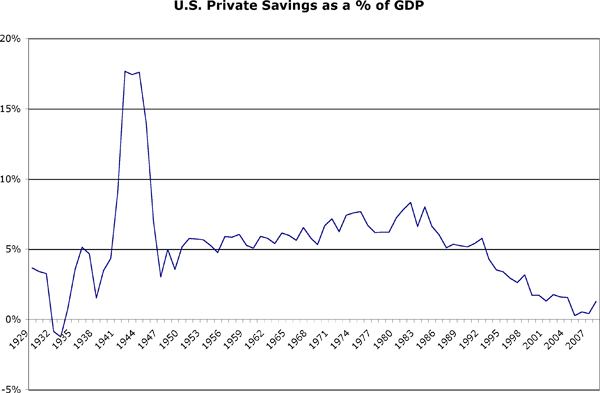

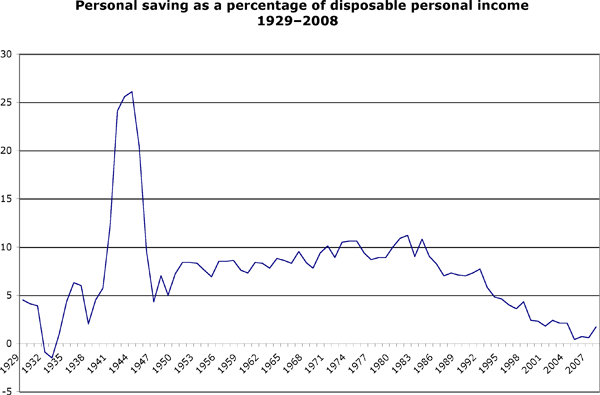

So where did all that money go in WWII? Tyler forgot to mention one little thing:

So…yeah. People didn’t spend the stimulus money in the war years. But as soon as all those war distortions went away…they did.

Tyler studiously ignores the massive scale of fiscal stimulus during the war — as if it were immaterial, and the Great Prosperity would have happened without it. Will he also ignore the spectacular, unprecedented (choose your adjective) amount of personal savings, and their subsequent dissolution?