All hands on deck! Run for the exits! The Economist has just reported that lending to businesses in the euro area contracted by 1.2% from October of last year to October of this year. With that kind of catastrophic free-fall in lending, it’s not hard to understand why unemployment has gone up by 28% in the Euro area and 33% in the U.S.

Sorry. Excuse me if I can’t resist being facetious. On multiple occasions I’ve questioned the accepted orthodoxy that a shortage of lending is central to our current difficulties, or to our economy as a whole. This seems like a good time to reiterate those questions and re-examine the answers.

First, understand this:

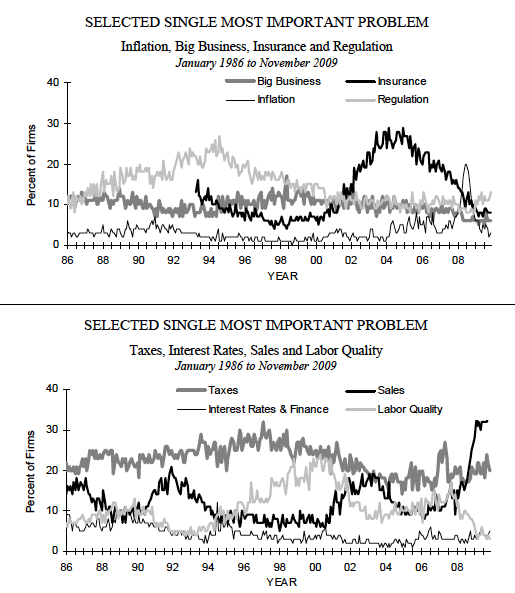

1. Small businesses consistently put financing and interest rates at the very bottom or near-bottom of their lists of business constraints. That has been true for many years, it was true throughout the recent crisis, and it remains true at this very moment.

What are they short on? It’s no surprise: sales, a.k.a. demand. See here and here, and for the very latest data from November 2009 (including the chart above), the PDF here.

It’s true that there are exceptions around the world. Says The Economist:

According to a Gallup poll published in September, small businesses in Greece and Croatia say that access to finance is their biggest problem. Credit concerns are high on the list for small firms in France, Hungary and Italy as well.

Okay then. Greece and Croatia. But in most of the world it just ain’t so.

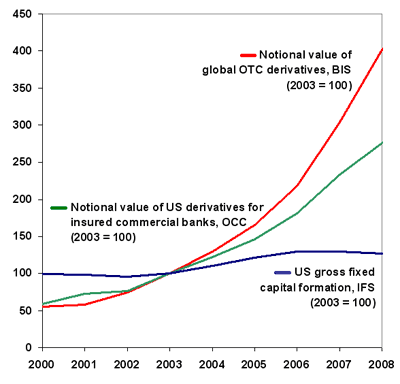

2. U.S. public companies disgorged every last penny they earned 2004-2008 ($2.4 trillion) in dividends and stock buybacks, plus another $200 billion–seven percent more than they earned. (Where’d they get the money? Cheap lending.) Does it sound like they were strapped for cash? With the big banks paying back tens or hundreds of billions in government loans only months after they were bailed out, are they strapped for cash now?

There are (still) truly oceanic quantities of cash flowing around this world, desperate to find solid, productive investments with decent promise of decent returns. A shortage of money and lending for business certainly wasn’t what got us into this mess, and there’s no sign that increasing lending to businesses will do anything to get us out of it.

But that belief system continues to bounce around the world echo-chamber–from the White House to Wall Street to The City to the MSM, even to the deepest corners of the econoblogosphere. BWWilds’ comment on the Economist story pretty much sums it up:

the money is not making its way to the small business owner and till it does no new jobs will be created.

That orthodoxy seems to go completely unchallenged, unquestioned, even unconsidered.

That’s certainly true in The Economist. Their December 12 article on “Europe’s corporate credit crunch” engages in extraordinary contortions to demonstrate the dire credit situation, using data that demonstrates…pretty much the opposite.

In their leader on the topic (bombastically titled “Small business, big problem: The sharp end of the credit crisis”), they share this graphic with us, demonstrating the precipitous decline in private-sector lending:

But of course this doesn’t show a steep decline in lending and borrowing. It shows a decline in the year-over-year growth in borrowing. Between 2004 and 2008 the amount of credit was growing by 7 to 12 percent a year–and it continued to grow (though more slowly) through most of 2009. Was that a good thing? Now it’s declining a little (by an amount that probably is not much greater than the survey’s measurement error). Is that a bad thing?

Then there’s the metaphorical title of the article–“Muck in the fuel pipe”–which displays a profound misunderstanding of the role of finance and lending in the business economy. Finance is not “fuel” for the “machine” of businesss–if anything, sales are, or maybe raw materials or labor. Finance is more like lubrication–it’s crucial to avoid things seizing up, but you don’t really need very much of it relative to the quantity of inputs and outputs.

Next, take a look at their front-and-center graphic:

…which re-creates this graphic from their source (Ifo):

Short story, for small and medium German manufacturers, credit is easier to get today today than it was in 2003, 2004, or 2005. (You didn’t hear of anybody complaining about credit crunches in those years.) Only large German businesses are experiencing more difficulties getting bank loans. In aggregate, things look pretty good:

And none of this says anything at all about how much constraint the lack of borrowing puts on businesses. In fact, it seems that the decline in lending is not because of a shortage of money or lenders, but because businesses aren’t asking for loans:

A German survey showed that in November the number of firms saying they faced tighter credit conditions ticked up again, having fallen for the previous three months (see chart). Yet a German government fund that is intended to help healthy companies borrow has had relatively low take-up to date. KfW, the state-owned bank that administers the fund, says it has received fewer than 4,000 loan applications for a total of about €15.6 billion ($23 billion), of which it has approved about half (granting loans worth €4.3 billion), mostly to small firms making car parts or industrial machinery.

Like small businesses in American, German companies aren’t clamoring for credit, even when the government’s trying to encourage them to borrow.

Ah, but it could be a problem!

The worry remains that when demand for credit picks up properly, disquieting clunks rather than the purring of a well-tuned engine will be heard from the banking system…

But even where the chances of a full-blown crunch appear remote, policymakers fret that if one set in, it would be difficult to reverse.

So most businesses around the world don’t report suffering from (as opposed to experiencing) a credit crunch, and there doesn’t seem to be any likelihood of a credit crunch emerging, and if one did emerge it might not hurt businesses all that much because they’re not really seeking loans in case, but…we really should really worry about it.

And it seems that policymakers are in fact worrying, especially about small businesses–the ones that are actually having less trouble getting loans:

The plight of small businesses, which are more dependent on bank credit than their larger peers, preoccupies policymakers. The ECB’s loan-officers survey showed that demand for bank credit weakened much more in the third quarter among big firms, which have access to capital markets, than among smaller ones.

So demand for loans is declining among both small and large firms, but more so among large firms, because they have other ways to tap into the oceans of global cash. But still:

Adam Posen, a member of the BoE’s monetary-policy committee, frets that Britain’s recovery may be stillborn because banks are not able to finance growth by small and medium-sized companies. The German government this month appointed a “credit mediator†to help smaller firms that are healthy but cannot get funding.

We’ve already heard about German companies’ response to those government efforts. Maybe policymakers should be “preoccupied” and “fretting” about something other than the health of lending institutions.

Likewise, I am agog when I hear reports like this about CIT–the big lender to small businesses that got itself in trouble recently:

“Small and medium-sized businesses are wild with concern that the bankruptcy filing of CIT Group will cut off the financing they use to pay employees and creditors…”

“They have to make payroll this week — they don’t know whether they will be able to meet obligations for payroll or for suppliers.â€

These companies are taking loans to make payroll? Should they even be in business? (Think: creative destruction?) Is the ability to shift payments a month or two back in time truly crucial to the well-being of our business economy? We’re not talking about investment in expansion here, or anything like it.

I’ve been a equity partner and/or principal in a string of successful companies with a combined worth well into the tens of millions of dollars. And I’m here to tell you: successful business owners invest to expand their businesses when there is 1) demand, or 2) expectation of demand. Absent that, all the credit in the world won’t make smart businesspeople invest in expansion. You don’t buy new machines or hire new staff to run them because you have lots of lubricant available.

Again, you don’t need very much lubricant (read: finance and credit) to make the machine of business run smoothly. By all appearances, we seem to have several times more than we need or than is good for us.

But still, we have this on the front page of the New York Times:

Obama Presses Biggest Banks to Lend More

President Obama pressured the heads of the nation’s biggest banks on Monday to take “extraordinary†steps to revive lending for small businesses and homeowners, prompting assurances from some financial institutions that they would do more even as they continued to shed their supplicant status in Washington, The New York Times’s Helene Cooper and Eric Dash reported.

Meeting with top executives from 12 financial institutions, Mr. Obama sent a clear message that the industry had a responsibility to help nurse the economy back to health and do more to create jobs in return for the huge federal bailout last year that kept Wall Street and the banking system afloat.

But Mr. Obama also confronted the limits of his power to jawbone the industry as banking companies continued to repay government money received in the bailout.

My question: instead of spending time jawboning and kowtowing to the bankers, should President Obama be waging a FDR-level jihad to rein them in and break them up? Or has he been convinced by his financial-industry advisors that the old orthodoxy–“Credit crisis! Need more lending!”–is true, and that he needs the banks as much as they need him?

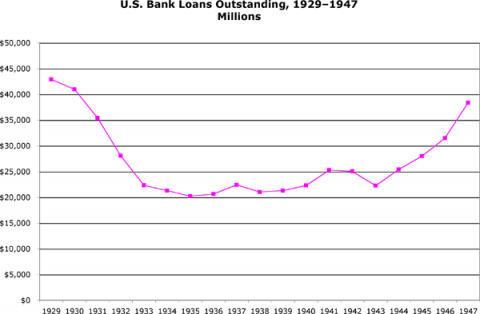

Do we, in fact, need them? We got out of the Great Depression without much help from their ilk:

And you have to wonder how much help they’re going to be this time.

Obama does mention regulation and reform in the NYT piece:

“I made very clear that I have no intention of letting their lobbyists thwart reforms necessary to protect the American people,†Mr. Obama said in remarks after the meeting. “If they wish to fight common sense consumer protections, that’s a fight I’m more than willing to have.â€

Okay babe, good words. Show us your stuff. To start with, you might consider some words like those that Roosevelt delivered:

The economic royalists hate me, and I welcome their hatred. The economic royalists have met their master.

Or to quote George W. Bush, “Bring ’em on.”

Comments

23 responses to “The Sky Is Falling! Business Lending Down 1.2 Percent!”

I agree with your points – which begs the question of why we are seeing this story play out. My sense is that the Fed is holding interest rates very low in order to allow banks to re-capitalize, and the big banks are making so much easy money that they can both re-capitalize and pay nice bonuses. This stirs up anger, and blaming banks for ‘not lending’ is an easy outlet. But what bank in this climate is going to provide loans to businesses that have no credible plan for expansion?

Where loans are indeed tougher to get is in housing, since some rational lending rules are now back in place, and many fear further price drops. Given that the housing loan ATM is now turned off, spending and demand is off, and many businesses need to retrench.

It seems to me that the ‘responsible officials’ such as Time’s Person of the Year Ben Bernanke, would like to find a way to get the economy back to how it was in 2006 – they don’t seem to see that much of the ‘growth’ from 2002-2006 was largely based on irresponsible lending. In order to try to make it happen, they will hold interest rates low for a long time, and provide various stories for why it’s the right thing to do.

>But what bank in this climate is going to provide loans to businesses that have no credible plan for expansion?

Exactly right. And businesses don’t have plans for expansion because there’s not enough demand. (Not because there are not enough loans.)

I really wonder if “Helicopter Ben” shouldn’t have lived up to his name: dropped all that bank cash from helicopters and let people spend it, while preparing to jack interest rates to deal with the inevitable inflation. Now for all I know that could have been disastrous (and it was almost certainly politically impossible). I like to give Bernanke credit for knowing whether it was, and I like to give Obama credit for being patient, judicious, non-radical, and playing the long game–the opposite of his predecessor. But you gotta wonder if he’s being too cautious by half, and as a result just continuing the smoke-and-mirrors game that began in 1980.

We need a much smaller financial industry, made up of much smaller firms. Does Obama have the cojones to make it happen? For instance, to give Volcker some real power? Ritholtz wonders the same thing:

http://www.ritholtz.com/blog/2009/12/why-obamas-poll-numbers-are-plummetting/

Yes, I saw the Ritholtz post – it does seem like the populist move, and I do agree that the financial industry needs to get smaller, one way or another. Volcker is anathema to Wall Street, so I’d be pretty surprised to see him given the reins on such an effort, should one start at all.

Overall I am not quite so confident in Bernanke. He did not seem to see this crisis coming, and he’s admitted he didn’t see it going so deep, so I’m not sure why I should put much weight on his current speculations.

Looking back, I could never quite follow why Greenspan took rates down so low in 2001 (was it really an ’emergency’ situation?), but I have to assume that things were more dire than they publicly let on. Now it feels like Bernanke is trying a repeat of that strategy, seeing it different only in degree, not in nature, and hoping for a similar replay of the 2002-2006 ‘recovery’.

Your ‘crisis of demand’ analysis reminds me of Galbraith’s message in The Affluent Society from 1958 (and his chapter on the conventional wisdom is classic!).

[…] The Sky Is Falling! Business Lending Down 1.2 Percent! […]

[…] The Sky Is Falling! Business Lending Down 1.2 Percent! […]

If the financial industry is better off to operate under many-but-smaller firms tenet, then what do you propose in being competitive on the global stage? Many conglomerate international companies, many of American origin, need these giant financial institutions to operate. Is there any viable solution to operate in an environment where much smaller financial companies provide necessary needs for them?

@Viran Large firms can issue equity and/or bonds. If they need instant financing, it’s a signal that “creative destruction” is or should be at play.

Like Paul Volcker, I’d very much like to see evidence that creative financing innovations–or any large-scale business lending–do anything at all to improve the business economy, or overall prosperity.

As I asked above, “Is the ability to shift payments a month or two back in time truly crucial to the well-being of our business economy?”

This all seems exactly right to me, as does the larger argument in your earlier posts. But how do we test it?

Hypothesis A: Wealth owners expect a certain return on their assets, but in some recent period there have not been enough investments offering that return to absorb all the available funds. So rather than accept the lower returns that marginal additions to the capital stock now produce (and presumably consume more of their wealth) as rational utility-maximizers are supposed to, they become increasingly susceptible to financial speculation that doesn’t raise output in the aggregate but seems to offer each individual investor the possibility of returns greater than the marginal product of capital. Under this hypothesis, financial reforms don’t address the fundamental problem; that would require either complementary public investment and/or epoch-making innovations (like what?) that could significantly raise the real product of new increments to the capital stock; or a redistribution of income away from asset-owners and to workers and the state, to reduce the pool of funds seeking investment. Without that, the best possible outcome of financial reform would be stable stagnation, since depriving wealth-holders of the illusion of high returns from speculation won’t in itself make the lower returns from productive investment acceptable.

Hypothesis B: There’s no reason to think the marginal productivity of capital has fallen, and even if it had, it’s impossible for a market economy to suffer from a chronic (as opposed to episodic) shortfall of aggregate demand. The problem is simply that the financial system has been sending the wrong signals about the the risk-adjusted returns for investment in various sectors. Once that’s fixed, growth will automatically return to potential. A more equal distribution of income and greater public investment might be desirable on equity grounds, or to deal with externalities, but they are not relevant to strictly macroeconomic policy.

One version of A is what you get from someone like Krugman, which says that the only fundamental reason the supply of savings and the demand for investment finance are out of balance is that the interest rate, which is supposed to equate them, can’t fall low enough. For him, it’s just the technical issue of the zero lower-bound, but I think — and perhaps you’d agree — that the resistance of wealth holders to accept returns below some threshold is much more deeply rooted than that. Or as Keynes put it, “the most stable, and the least easily shifted, element in our contemporary economy has been hitherto, and may prove to be in future, the minimum rate of interest acceptable to the generality of wealth-owners.” If you believe that you’re potentially left with a much stronger conclusion than Krugman would accept, that restoring full employment and growth is unlikely without a large *permanent* increase in public spending and/or downward redistribution of income.

I think Hypothesis A is right. You seem to believe something similar. But how, empirically, do we distinguish it from hypothesis B?

Thanks for coming by, JW. Much more in your comment than I have time to address right now, but: yes, I’m left with a conclusion much stronger than Krugman’s.

He wrote once something like “I see no reason why the rich could not provide all the spending necessary for a robust economy.” (Probably a serious misquote, but along those lines.)

I think that’s crazy.

Some quantity of redistribution seems necessary to a high-productivity, post-industrial economy–at least, no such economy has emerged absent huge amounts of redistribution.

Our tax system isn’t nearly progressive enough to support what’s needed. IOW, the rich aren’t paying their share (they get *far* more out of the system than they put in):

http://www.asymptosis.com/politicians-should-resist-equality-and-prosperity.html

http://www.asymptosis.com/most-regressive-taxes-my-home-state.html

The amount of redistribution, and the methods, are open to debate, including debates between equity and efficiency. Personally, I am 100% with Steve Randy Waldman on the subject: flat transfers of fixed amounts to every citizen:

http://www.interfluidity.com/v2/171.html

Call it the “Alaska Model”?

I would also add: the last thirty years have consisted of a wild, unending excess of Reaganomics-driven keynesian stimulus (if you define keynesian stimulus as “deficit spending”).

http://www.asymptosis.com/whos-fiscally-responsible-1.html

But it hasn’t been spent efficiently.

Until last year, I was scraping by on a small pension, and all of it went into essentials like heat, light, food and phone. I also sustained two items that might fall under the category of “luxuries” — a small car, and broadband internet.

I am guessing that money spent on essentials doesn’t froth up the economic waters a lot.

I had been looking for some sort of work for four years, unsuccessfully. Last spring I lucked out and landed two part-time jobs, essentially doubling my income. Can you guess what happened to that money?

House repairs. Computer upgrades. A part-time gardener to help me reclaim my longsuffering yard. A couple of power tools. Nice breakfasts on payday, one of my modest luxuries. A newspaper subscription. And a whole slew of smaller purchases and household tweaks that have been needed but impossible until last year. MY EXCESS INCOME WENT INSTANTLY INTO PURCHASES.

This coming summer, at least three home projects still wait to be done — a new garage door, attic insulation upgrade, a kitchen floor and new cabinets. A couple of windows, perhaps. Basement upgrades, maybe. And more gardening.

The bankers don’t get it. Access to loans is a moot issue at my level of income — a level shared by perhaps a third of Americans. Business doesn’t need loans, it needs customers. Businesses manufacture customers for other businesses (and themselves) by paying salaries.

The glitch is that in trying to cut costs, businesses cut their “manufacture” of customers. If one business can manage this, it gets a leg up on other businesses by letting them provide the customers for it without reciprocating. They want the profit frosting while expecting others to supply the customer cake. When they ALL do it there’s no cake, and no frosting either.

Hi Steve. I am finally getting things sorted and catching up with blog business. Nice post…Dan Becker did the small business point of view using his flower shop as a point of reference.

@Rdan

at Angry Bear.

[…] market with reasonably accurate price signals.) This especially as business owners consistently tell us that investment is dead last on their list of business […]

[…] market with reasonably accurate price signals.) This especially as business owners consistently tell us that investment is dead last on their list of business […]

[…] to share data demonstrating exactly the same thing (this in the midst of the “crisisâ€), in an article that tries desperately to claim exactly the […]

[…] money flows (though it’s darned hard to discern that friction), businesses consistently tell us that shortage of financing is the very last thing on their list of business constraints. Fact: The […]

[…] economic ideology. Coupled with the faith-based (and also false) notion that the available supply of investment funds is an important constraint on business […]

[…] familiar (and delusional) self-serving lionization of financial-industry “intermediation” completely misses the […]

[…] familiar (and delusional) self-serving lionization of financial-industry “intermediation” completely misses the […]

[…] familiar (and delusional) self-serving lionization of financial-industry “intermediation†completely misses the most […]

[…] The Sky Is Falling! Business Lending Down 1.2 Percent! […]

[…] The Sky Is Falling! Business Lending Down 1.2 Percent! […]