I’m finally getting around to following up on a graph I posted sort of in passing a while back, a graph that to my eyes makes a profound statement about our country and our economic system.

It shows total taxes paid–local, state, and federal combined.

People making $55-90K (fourth quintile, approx.) pay the same share relative to their share of income as those making hundreds of millions. Above $55K, U.S. taxes really aren’t progressive. Like, at all.

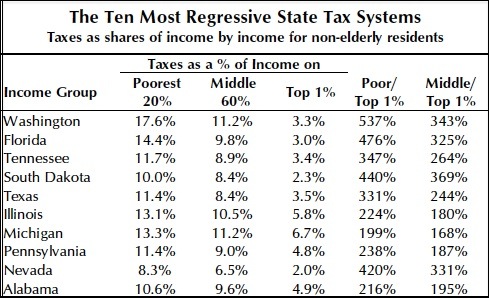

So-called conservatives love to crow about how progressive federal income taxes are. But of course (as is their wont), they ignore the inconvenient truths about payroll taxes, and state and local taxes–which in general are horribly regressive. And I’m depressed to say that my home state is right at the top of the list:

Middle-class taxes in my state are three and a half times what they are for rich people. Poor people’s taxes are five and a half times what they are for rich people. This is unfair, of course, but truly even more important, over the long term it makes everyone worse off–including the rich people.

I know, I know: “Look how well Washington is doing. It’s thriving!”

Uh…look at the rest of the states on the list. Tennessee? Michigan? Alabama? I don’t think we need a scatterplot or trend line to draw a judgment on that idea.

Comments

4 responses to “Most Regressive Taxes? My Home State :-(”

If you don’t like Washington state taxes, speak now. Write your state

representatives, they are looking for ideas to raise revenue. Personally

I don’t want to do the paper work for an income tax so these are my favorite

ideas:

A progressive property tax (rather than flat).

Increase tax rates for non-primary residence real estate (so no one will

lose their home due to tax hike).

Raise the gas tax, but for god’s sake give me a decent bus route to work

first (not going to happen).

I remember you well Steve, from Western, (Sandy aka Don’s gf), and it tickled

me to see you’ve done well and are putting out good opinionated stuff!

S

I’d like to see a land-only tax. Progressive sounds good, but I can’t really figure how you’d scale it. Based on what? Non-primary is a *very* good idea. Hadn’t thought of it.

A progressive tax on car purchases is another good one–scale it on price, and also on fuel economy.

Property taxes still come when people are fired downsized laid off, etc. Income taxes show an ability to pay.

@Steve Breeze Property taxes still come when people are fired downsized laid off

True. I do like the idea of land taxes, from what little I know.

http://en.wikipedia.org/wiki/Land_value_tax

But I haven’t really researched this at all.

It’s a matter of having the right mix. And I see no prospect of reworking the whole national tax system…