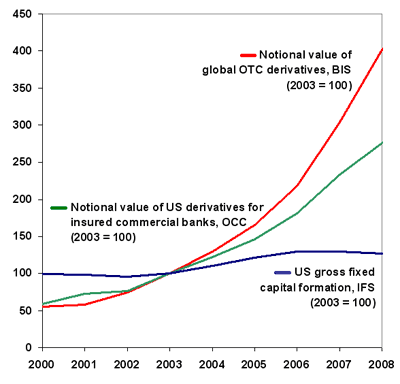

Following up on posts here, here, and here questioning the supply-side orthodoxy that more money for the rich results in more investment, hence prosperity for all (see the long-discredited Say’s Law), I give you this (click for source):

Between 2003 and 2008, US gross fixed capital increased by about 25 percent, a reasonable number during an economic expansion, but hardly a boom. During the same five-year period, the global amount of over-the-counter (OTC) derivatives increased by 300 percent.

Those “creative” investment vehicles didn’t really increase the national (or global) wealth–its capital stock. At best they improved the pricing mechanism of the markets a wee bit, at the margins. (But since they mispriced risk so egregiously, even this is questionable.)

As James Livingston has pointed out, when too much money goes up the ladder, there simply aren’t enough productive investments available for that money (because there’s not enough money and spending down the ladder to make those productive enterprises profitable). So rich people have no option but to resort to…gambling.

We need a healthy financial sector to support productive enterprises–one that is much smaller relative to the economy than it was in recent years. And we need money and enterprise circulating in the lower tiers to generate prosperity for all–including the rich.