Here’s the central tenet of supply-side/trickle-down/voodoo Reaganomics:

If rich people get (and keep) more money, they will invest it and promote economic growth, so everyone will prosper.

That would (perhaps) be true if a shortage of investment were an important constraint on businesses and on economic growth. But according to the people who run those businesses, availability of investment money is the least important constraint.

A company called Grant Thornton runs an annual survey (PDF) of privately held businesses worldwide, asking them among other things what constrains their growth.

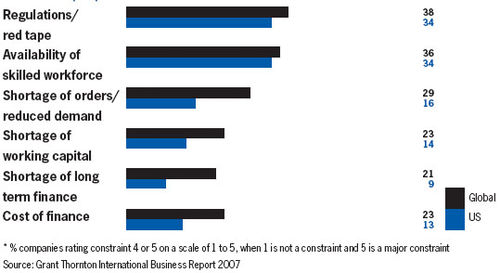

In 2007, only 9% of privately-held U.S. businesses (21% worldwide) cited a “shortage of long-term finance” as a constraint on expansion.

Constraints on Growth Reported by Privately-Held Businesses

Presumably even fewer cite it as a “major constraint.” Both domestically and worldwide, it ranks dead last on the list of business constraints.

(I can attest to this from personal experience. My partner and I had to make some small–low five-figure–personal loans while building a multimillion-dollar business. But we never tapped credit of any kind–though we could have, easily).

Understand: these are privately-held businesses being surveyed–not public corporations (which have far greater access to financing through debt and equity issues, and from massive global pools of private-equity and sovereign-wealth cash). These are the very hotbeds of entrepreneurship that supply-siders constantly tout as the innovative engines of economic growth.

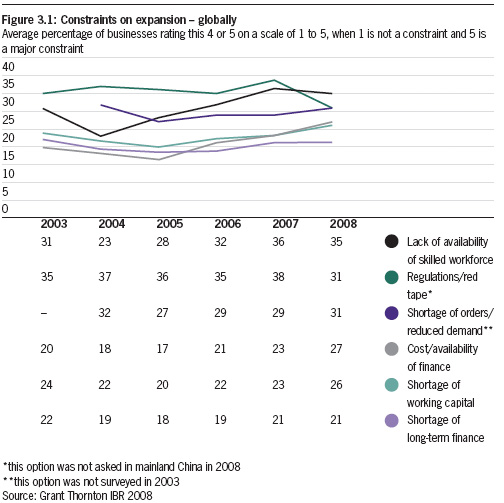

A dearth of financing definitely isn’t impeding their growth. Grant Thornton’s 2007 study puts regulations and red tape at the top of the list, and it’s been there for some years. But in 2008 (for which I can only find global numbers), that changed.

A shortage of skilled workers in now the #1 constraint. (35% of businesses cited it.)

This is completely in keeping with the economic view so ably explicated by James Livingston, which I summarize and link to here. The fact is that wealthy people can’t find truly productive investments offering sufficient returns, so they turn instead to investments that don’t have anything to do with production or productivity. (Think: MBSes, CDOs, CDSes, etc.)

Since the greatest constraint on growth is currently a shortage of skilled workers, the best path to prosperity seems to be taxing those unproductive dollars and investing them in the thing that every economist (and most people and politicians) agree is prosperity-producing: education.

Making sure that wealthy people have plenty of money is not the way to produce prosperity. That’s a self-serving myth–one that needs to be soundly discredited.

Comments

5 responses to “Do Wealthy Investors Create Growth and Prosperity? Not So Much”

HAHAHAHHAHAHAHAHAHAH!

Who wrote this drivel??????!!!!!!?????

The problem today is that we have a lack of qualified employees? HAHAHAHAHAHHAHAHA

Why don’t you go ask some of the (MANY) recently unemployed how they like being called unqualified.

This author (assumably a teacher, professor, or lobbyist from the NEA) takes a 21 month old survey from before the recession and uses it to expound on the need to expand the educational monopoly. Too funny. Perhaps they should take an economics course.

Hey, author, did you hear about the credit crisis? It’s been in the news lately. I understand if you are too busy writing grants to get money form me, or attending meetings to increase my kids tuition so you can get another raise, but this is ridiculous.

Here’s a couple of things you may want to study up on.

First, the credit crisis is having a major effect on companies receiveing money to either a.) start-up, or b.) expand. This creates a problem because if the factory cannot get credit to expand, they cannot hire new workers, build new space, etc. Also, these companies will not make as much of a profit and may have to lay-off workers. Again, author, please see the recent news. And not the New York times, please. therefore if companies are not hiring, expanding, etc. all these newly educated people in your world, will actually have no where to work in the real one.

Also, if your argument is eventually supposed to conclude that government financing of education, economics, and general takeover of ever aspect of our lives, perhaps you should review history and see how well socialism has worked up to this point. Not very well. i don’t see a whole bunch of educated employees rushing down to Venezula right now.

HAHAHAHAHAHAHA.

vikesmike – he was talking about a long-term trend, not how to deal with short-term credit crisis. perhaps you should read the article before you start laughing obnoxiously and talking about completely irrelevant things.

but if you do want to talk about the short-term credit crisis, you should also do a little research on the impact that the tax cuts had on credit vs. other forms of stimulus. turns out that when times are hard, people save the extra cash! it doesn’t magically turn into new businesses.

[…] while back I pointed out that in 2007, only 9 percent of U.S. privately-held businesses cited a shortage of investment money […]

[…] Remember: few businesses are seriously constrained by a lack of investment capital (only 9% in the U.S.). Many are seriously constrained by a lack of skilled workers (35%). […]

[…] are they short on? It’s no surprise: sales, a.k.a. demand. See here and here, and for the very latest data from November 2009 (including the chart above), the PDF […]