Dick Cheney famously said, “Reagan proved that deficits don’t matter.” I’ve argued elsewhere that this was a political, not an economic statement. People love to complain puritanically about debts and deficits, but they vote for politicians who promise to cut their taxes. Hence the 30-year hegemony of Reaganomics.

But do deficits mattter (economically)? In particular, does high government debt result in slower economic growth one year, ten years, or twenty years down the line?

There’s been quite a bit of discussion lately in the econoblogosphere (see here, here, here, here, and here) of a recent paper (PDF) by Carmen Reinhart and Ken Rogoff, “Growth in a Time of Debt.” Their conclusions, in brief:

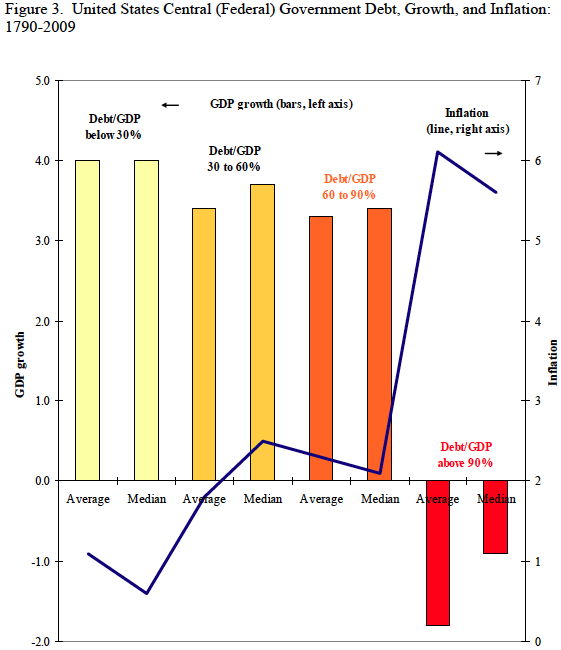

First, the relationship between government debt and real GDP growth is weak for debt/GDP ratios below a threshold of 90 percent of GDP. Above 90 percent, median growth rates fall by one percent, and average growth falls considerably more.

I’m here to say that while their data set is impressive, their analysis is so weak–downright amateurish–as to make any conclusions in the paper largely useless. Given the same data set, any bright, diligent freshman with a copy of Excel could produce the same analysis with less than a day’s work. They could produce much of what’s provided using easily accessible, web-available data.

The paper, it seems to me (in my amateurish ignorance), makes the most basic error that I see in almost all “determinants of growth” econometrics: it doesn’t consider multiple lags–what periods (of debt) are being compared to what ensuing periods (of growth).

Post hoc obviously doesn’t mean propter hoc, but “ensuingness” is one of the few natural-experiment handles we’ve got in a science where you can’t re-run the experiment.

While the paper (oddly, it seems to me) doesn’t say so explicitly, it seems to be comparing a country’s debt levels in a given year to that country’s GDP growth in the same year. While the data set is impressive (are they sharing?), the analysis is based on the most simplistic of correlations.

And it’s not even adjusted for the most widely-accepted of necessary corrections–“convergence” or the “catch-up effect”–the tendency of less-prosperous economies to catch up with their cohorts due to transfers of technology, expertise, trade, capital, etc. (Which effectively changes the question to something like, “Gee, these countries didn’t catch up, when they should have.” Or “This country keeps surging ahead. Why?”)

Also, the paper only looks at GDP growth–not growth in GDP per capita, which is necessary to correct for different population growth rates in different countries.

But putting those two issues aside: Reinhart and Rogoff acknowledge their lag-blindness in a decidedly less-than-reassuring parenthetical (p. 7):

(Using lagged debt should not dramatically change the picture.)

“Should not.” Now that’s a convincing piece of robustly supported econometric evidence and argument, don’t you think?

The paper provides at least one perfect–downright eye-popping–example of this lag-blindness, and the false picture it paints. In Figure 3 (p. 10), they show their debt-to-growth correlations (broken into their “buckets” by debt/GDP ratio) for the U.S., purportedly demonstrating that debt/GDP levels above 90% result in far lower GDP growth levels.

But note the footnote to this table: they have only 5 samples (years) out of 216 in which debt/GDP was greater than 90%.

It’s not hard to figure out what years those were:

U.S. Federal Debt as a Percentage of GDP

1944 91.45

1945 116.00

1946 121.25

1947 105.81

1948 93.75

1949 94.60

I find six years to their five, but in any case.

This was a period of profound economic turbulence–the years when our economy was struggling to recover from the massive back-and-forth swings of unprecedented economic forces in the preceding 10-15 years. Things didn’t smooth out until the fifties. If these years constitute Reinhart and Rogoff’s “proof,” well…there’s just not a lot of there there.

While arguments can be made to the contrary, it’s not insane to suggest that the deficits of the war years—finally breaking the back of The Great Depression–and the resulting debts of the late 40s, were in fact the impetus (or at least enabler) for The Great Prosperity of ensuing decades.

But whether or not you buy that argument, this example demonstrates that Reinhart and Rogoff’s lag-blindness in this paper (combined in this example with a completely misrepresentative five- or six-sample data set) quite resoundingly undercuts the value of its conclusions.

Their choice of correlations–year-X debt to year-X growth (or to be precise, growth from the preceding year to year X)–exemplifies a dismaying tendency among U.S. growth econometricians, particularly those like Rogoff who display a predilection for making political points and getting on talk shows: a tendency to concentrate on short-term results rather than long-term benefits.

I think almost all will agree that the important question we need to be asking is, “What effect will debt levels have on our (country’s) long-term prosperity and well-being?” Will our children and grandchildren decades hence be more or less prosperous as a result of Policy X, or Policy Y? (This also because we can actually have an effect on those long-term outcomes–if we think and plan long-term, and act diligently.)

In my amateurish way, I’d like to suggest that answers to those questions can be found more readily by looking at many lag periods for any given correlation. In particular–since many important economic effects (arguably the most important ones) play out over many years or decades, and it takes years or decades to implement significant policies–we should be looking at long lag periods to draw our conclusions. This also has the statistical benefit of smoothing out short-term blips and bleeps in the data that serve only to confuse and pollute our judgments (and of course provide splendid opportunities for cherry-picking).

Here is one example of long-term, multi-lag, multi-period analysis–comparing U.S. to EU15 GDP/capita growth rates for all the periods from 1970 to 2006. (I apologize that this is not corrected for convergence/catch-up.)

http://www.asymptosis.com/europe-vs-us-who%e2%80%99s-winning.html

And another example here, suggesting that wealth equality correlates with somewhat slower growth in the short term, but profoundly faster growth in the long term. (Again, not corrected for catch-up.)

http://www.asymptosis.com/wealth-equality-and-prosperity.html

I’m sorry to say that I don’t have time at the moment to pull this kind of analysis for the debt-to-growth correlation. Anyone care to do so? Reinhart and Rogoff, can we borrow your data set please?

Update March 3. I should add based on comments elsewhere: I am in no way arguing that debt is benign (based on Ricardian equivalence or whatever), or that there might not be some thresholding effect where it starts to have decidedly non-benign effects on short- or long-term growth. Obviously there has to be a point where it would.

I’m simply saying that because of their analysis methods, R&R’s paper doesn’t give us any real insight into that. Because of their zero-lag analysis, they certainly give no insight into the long-term effects, which strike me as the effects that really matter. Compounding interest and all that…

Comments

4 responses to “Deficits Don’t Matter? The (Supposed) Experts Speak”

well you clearly managed to screw them over. 😀

Casey Mulligan has also been saying debt isn’t so bad:

http://caseymulligan.blogspot.com/2010/02/more-government-debt-please.html

Today we are paying $200 billion in interest on the public debt. That is 1.4% of GDP that is being pulled from the economy and diverted to those we owe. Reinhart and Rogoff’s data therefore conform well to today’s environment where gross debt to GDP ratio is about .90.

[…] As I pointed out, for the U.S. their sample ouf 216 country/years includes five (I found six) years of debt at that […]