Political Calculations gives us this chart of median new home prices versus median incomes over the last 46 years. The rising tip at the upper right (!) is May 2013. What do you think: sustainable?

Here’s the zoomed-in version of recent years, from inside the red dashes:

As they say,

…new homes are, virtually by definition, at the margin for all real estate markets. Their prices are therefore especially sensitive to changes in the levels of both supply and demand in the overall market.

Wow. THE RULES OF THE GAME MUST HAVE REALLY CHANGED between 2000 and 2001.

They suggest it was “money leaving the U.S. stock market” and flowing into the housing market, which is no doubt somewhat true. But:

1. A great deal of that dot-bomb money didn’t “go” anywhere; it simply vanished. You gotta ask: this would result in more money going into real estate, with the off-the-charts results we see above?

2. Have we ever seen a stock-market crash causing a real-estate bubble? I can’t think of an instance, but I could be wrong…

3. That’s your typical lump-of-money/loanable funds incoherence, ignoring the fact that the financial system creates new money and lends it to the real sector to buy houses.

I’d suggest that there was a sudden increase of availability of new money. Yeah, Greenspan spiked the punch bowl at the same time, so the money was cheaper. But I’m thinking that lending standards plummeted starting in 2001.

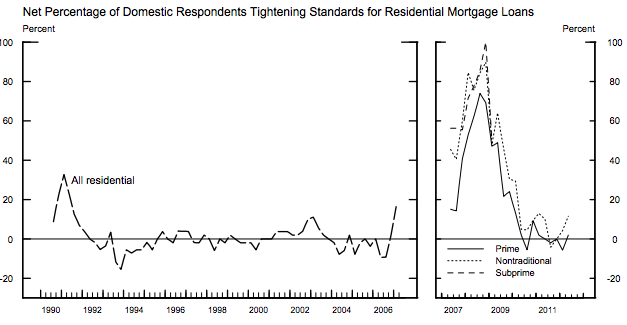

The Fed asked loan officers if they were loosening their standards in that period. They said no:

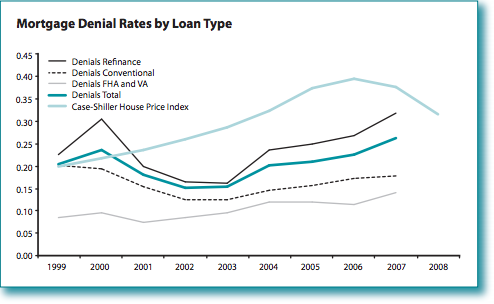

But — surprise — the rate of loan denials tells a very different story:*

This is in the midst of a massive stock-market crash. Denials declined? Those loan officers apparently didn’t even know they were loosening their standards.

Here’s another Fed graph that’s less dramatic, and that doesn’t seem to match the ’99-’00 Conventional Mortgage numbers in the data I graph above, even though they’re drawing from the same data set. (Je ne sais pas.) But the 2001-2003 trend’s the same, and even more pronounced for refinancing:

So what could possibly cause this sudden decline in lending standards? I’ve got a guess; again, it’s about the fundamental rules of the game being changed. Nothing else could cause such a radical shift. Here’s my guess:

Wikipedia: Commodity Futures Modernization Act of 2000

Pushed through by Lindsey Phil Graham in the dark Christmas-recess nights and signed over Clinton’s powerless, almost-dead body in the midst of the Lewinsky crisis (signed December 21st, 2000), this act empowered and deregulated all the collateralized debt vehicles that stood behind the runup, and emasculated any putative regulators. (It apparently took the financial players most of a year to take advantage of the new rules.)

AIG and its ilk were given free rein to sell any default-insurance contracts (CDSes) on banks’ bundles of mortgage loans (CDOs) that contributed to their personal bonuses– no matter that they could never fulfill those insurance contracts if the S hit the F.

The ratings agencies (for their pieces of silver) issued their blessings on those CDOs, which meant the CDS insurance on the CDOs was ridiculously cheap.

The main-street loan-shark mortgage brokers had no problem foisting their shitty loans off to the banks for bundling into CDOs, which were “insured” by AIGers who never intended to pay off anyway. They figured they’d never have to, based on their self-serving models, crafted under intense pressure from their sales and executive (what’s the difference?) teams.

Is it any wonder that lending standards plummeted? I’ve heard it said that incentives (and institutions) matter.

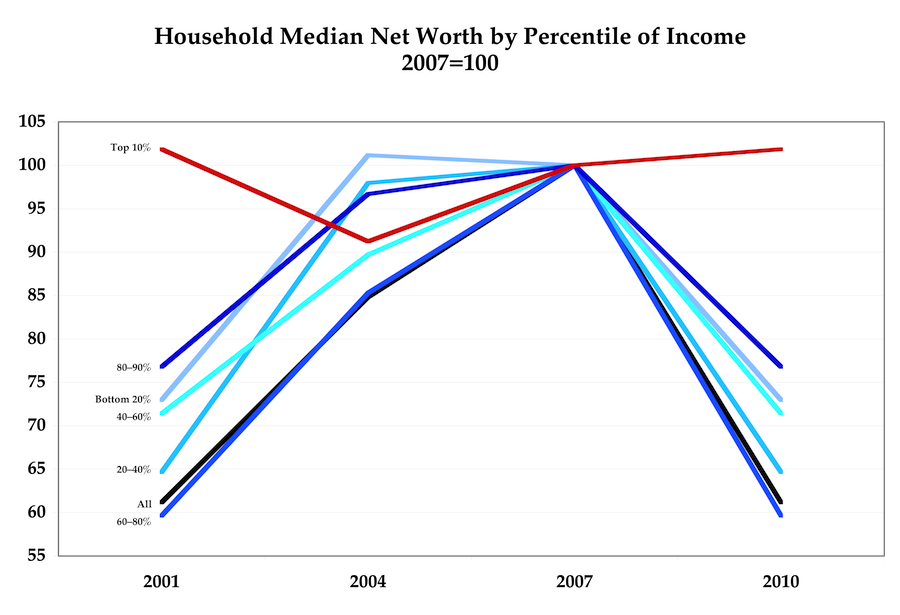

So where are we now, with the home-price/income ratio trending up off the charts again, and even higher now? Maybe it’s just that home builders aren’t building any inexpensive homes anymore, because the people who buy those homes have been eviscerated:

If that’s true, that scary runup in the upper-right corner of the first graph is the top .1% — having extracted everything they can from the 90% who have no money, really — finally going all Willy Sutton on us and going where the real money is: the top 10%. I wonder: how will those ten-percenters will feel about the glory and wonder of “free markets” a few years from now?

* You’d be amazed how hard it was to dig up these numbers. Even though the Fed’s been collecting this data for decades, the report I found it in didn’t include the data in the tables (and said so, explicitly, in the text). The micro-level data is available through the FFIEC interface to the HMDA data, but you have to be a serious wonk to download and crunch it. And nobody else seems to have compiled this time-series on percentage of loans denied. All the research is about comparing denials for different income classes and races. Liberals are looking at just one thing (the wrong thing, for what I’m describing), and conservatives are just ignoring the whole thing.

Cross-posted at Angry Bear.

Comments

3 responses to “What Caused the (Next) Housing Bubble? (Six Graphs)”

Very interesting – the role of the Commodity Futures Modernization Act is definitely worth checking into as a contributor to the first housing bubble, although a quick survey of mortgages loans by type by year suggests its effect may have taken a little bit longer to get large-scale traction than just a year. But that would also be expected….

As for the dot-com crash causing the housing bubble – the thing to keep in mind that it was a lot more gradual than most people seem to remember – in 2001, it was very possible to pocket gains from investments made as recently as in 1998 (money only disappeared for people who simply held during the period). And then, for the money that did exit, it went somewhere, with a lot of it going into residential real estate.

(And believe us when we say that we appreciate how difficult digging up data can be!)

@Ironman Yeah I also looked at quantity of mortgages, though so many factors affect that that I had trouble drawing good inferences from it.

As for the money-going-somewhere link, I clicked the link therein for “relative shortages,” and my impression is that months-of-supply stayed pretty steady and random-walkish through the period we’re looking at. (I just eyeballed it for highs, lows, and obvious trends, so take that for what it’s worth.)

But still: even though change took some time (different amounts by different measures), the main thing looking at the zoomed-out big picture is the unprecedented suddenness, magnitude, and duration of the change starting November-ish 2001. I just can’t figure how normal market forces could cause that. It seems like the playing field (or actually the rules) must have shifted. And the CFMA looks like a pretty reasonable candidate.

[…] Cross-posted at Asymptosis. […]